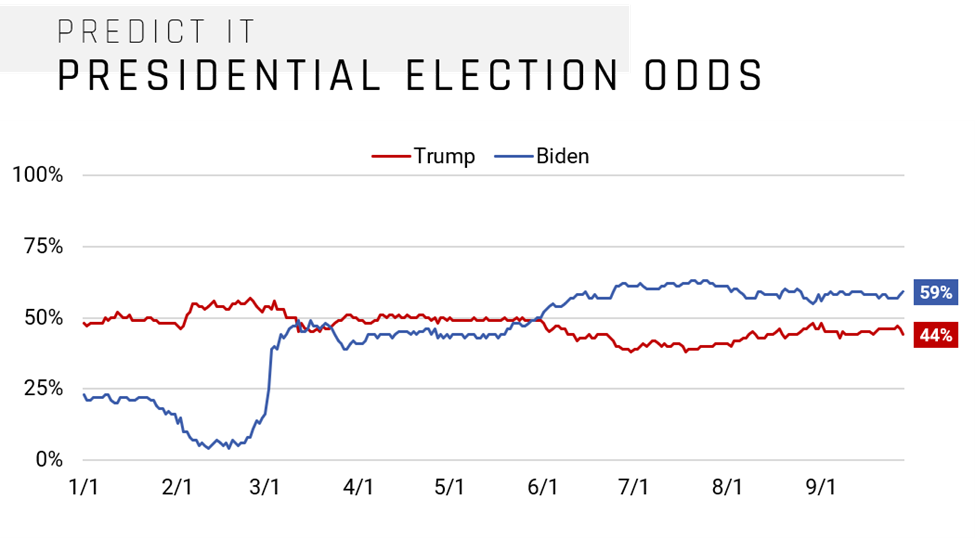

Depending on who you ask, “it’s already priced in” may be the least helpful phrase in finance. Our friend Barry Ritholtz recently wrote a piece for Bloomberg titled, “The 10 Most Useless Phrases in Financial Markets” and the ninth most useless phrase was “it is already in the price.” When is the phrase used? When big news hits the wires and has a little noticeable impact on the underlying components. The phrase can be used with accuracy and utility. However, it is usually deployed by analysts and media outlets as a different way of saying “markets are efficient.” Surprises are not “priced in.” However, common knowledge is certainly “already in the price.” Over the weekend, the New York Times posted an article revealing the tax status of President Trump. For years, his political opposition has shown tremendous effort to find and bring light to these documents. Therefore, a lot of people would consider that big news. The betting market, while not the most efficient but as honest as any place that you can gauge the odds of a presidential race, did not consider the NYT story to be big news. As the chart below shows, it had minimal impact. “It’s already priced in.”  Of course, being priced in is a head nod to both markets incorporating all known information while simultaneously calibrating around expectations. If there is one thing that 2020 has taught us, our expectations of the future should be held with the humility of knowing how unknown the future really is. Looking at the expectations around significant macro figures can help us understand where the consensus lies and where an outlier could make an impact on market direction. Below are two charts highlighting consensus expectations regarding US GDP Forecasts and another regarding consensus expectations of US government debt as a percent of GDP. Both charts show the actual figure, as well as an upper, lower, and average range.

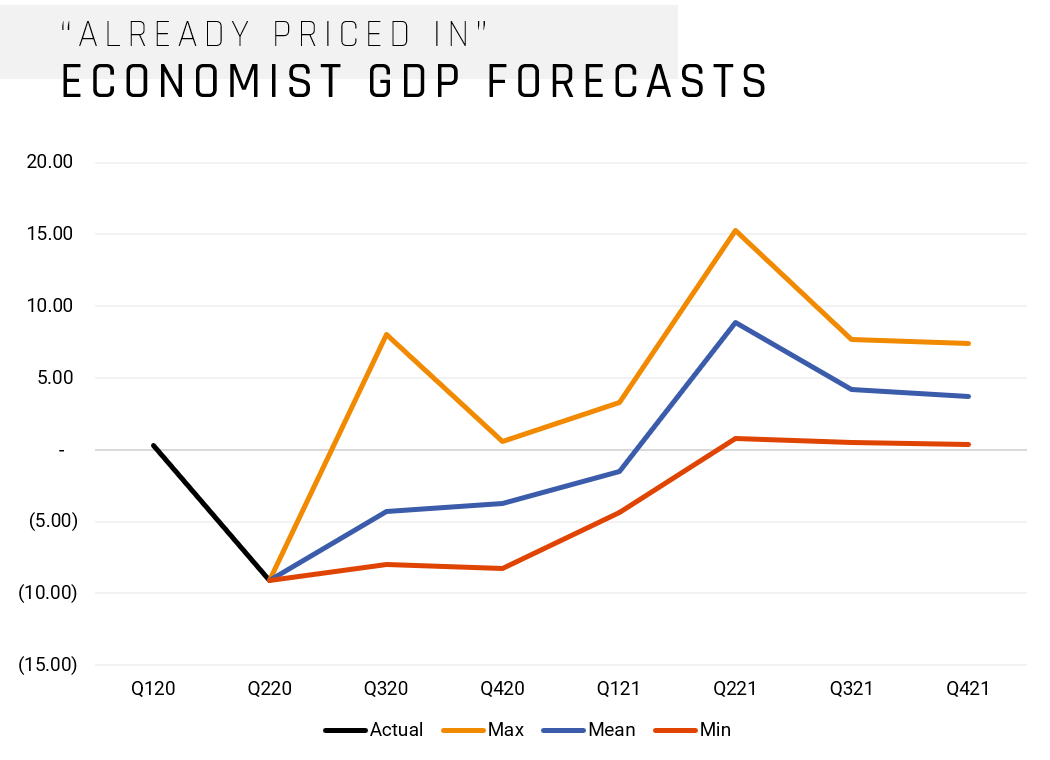

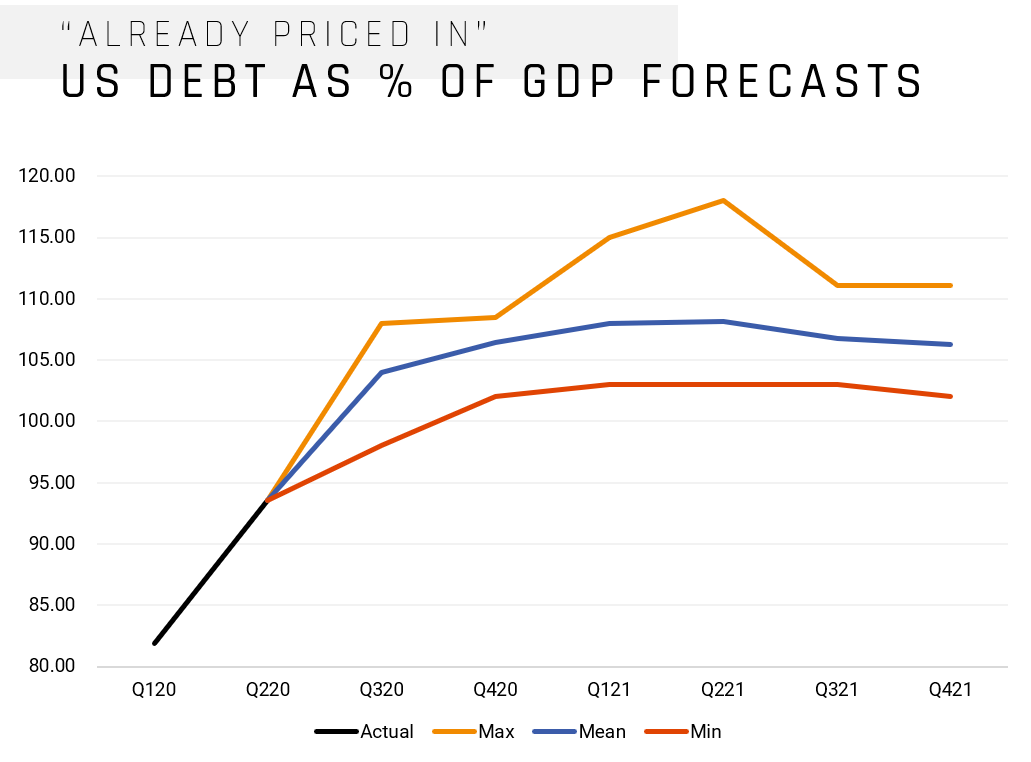

Of course, being priced in is a head nod to both markets incorporating all known information while simultaneously calibrating around expectations. If there is one thing that 2020 has taught us, our expectations of the future should be held with the humility of knowing how unknown the future really is. Looking at the expectations around significant macro figures can help us understand where the consensus lies and where an outlier could make an impact on market direction. Below are two charts highlighting consensus expectations regarding US GDP Forecasts and another regarding consensus expectations of US government debt as a percent of GDP. Both charts show the actual figure, as well as an upper, lower, and average range.

As you can imagine, a lagging indicator like GDP has already been priced into the financial markets. What could cause a surprise in this arena of GDP and government debt? Well, the chart below, of course.

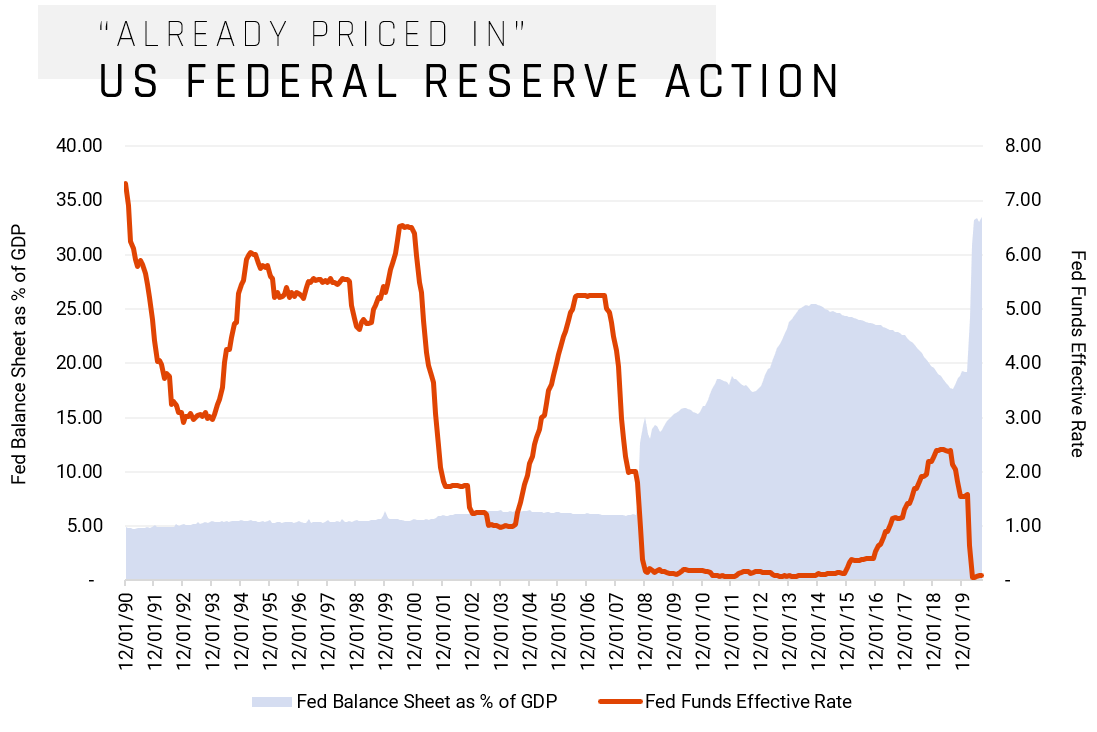

As you can imagine, a lagging indicator like GDP has already been priced into the financial markets. What could cause a surprise in this arena of GDP and government debt? Well, the chart below, of course.  Not one soul knew in December of 2020 that the Fed was going to take massive interest rates and balance sheet action several weeks later. The unknown unknowns should not stop us from investing. However, developing key indicators and a sound methodology to allocate will create confidence by understanding the mechanics of why the investment experience is unfolding the way it is – no matter the political climate. The markets do not care about our personal views of deterministic outcomes. Instead, aligning your investment strategy around probabilities and potential for risk/reward is a comforting vantage point when faced with what is and what isn’t priced in.

Not one soul knew in December of 2020 that the Fed was going to take massive interest rates and balance sheet action several weeks later. The unknown unknowns should not stop us from investing. However, developing key indicators and a sound methodology to allocate will create confidence by understanding the mechanics of why the investment experience is unfolding the way it is – no matter the political climate. The markets do not care about our personal views of deterministic outcomes. Instead, aligning your investment strategy around probabilities and potential for risk/reward is a comforting vantage point when faced with what is and what isn’t priced in.

- SolutionsOpenClose

- Insourced CIOOpenClose

- Helios ToolsOpenClose

- Confidence Rating ProcessOpenClose

- Customized ModelingOpenClose

- Why HeliosOpenClose

- Getting StartedOpenClose

- Resources CenterOpenClose

- TeamOpenClose