- The S&P 500 has been wavering near its all-time high, alongside the Nasdaq 100 and the Dow Jones Industrial Average, fueled by the artificial intelligence boom and expectations of a more lenient Federal Reserve.

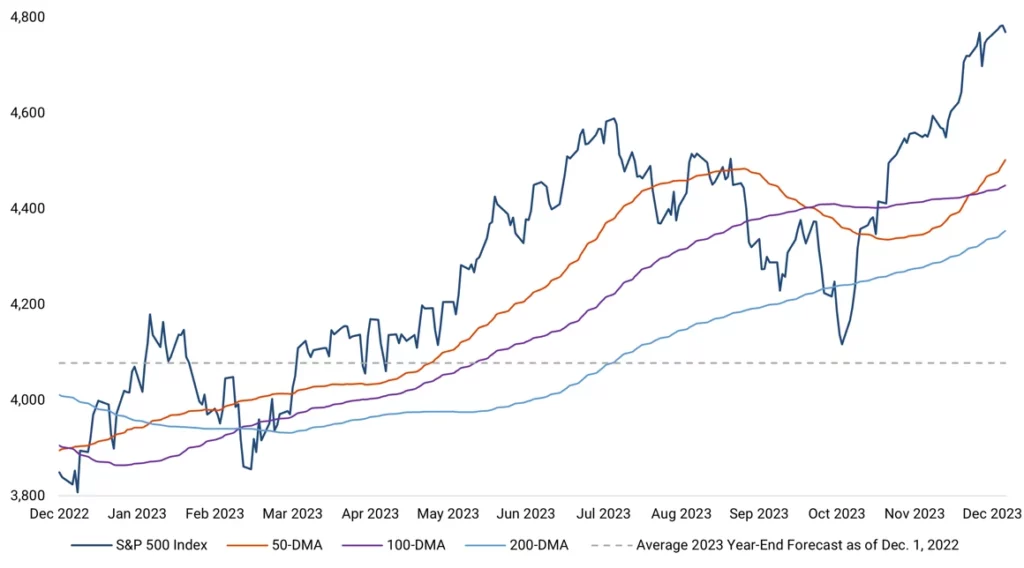

- At the end of 2022, strategists forecasted that the S&P 500 would end 2023 at 4,078. Instead, as of December 29, 2023, 85% of S&P 500 stocks are trading above their 50-day averages, hinting at potential market overexuberance.

- Since 1950, there have been 11 occasions where the S&P 500 declined 20%, and a rally followed that brought it to within 1% of its previous all-time high. Each time, the index established a new high, typically within a median period of seven days and no longer than 20 days. Based on this pattern, new highs are expected in January 2024.

- Historically, the S&P 500 continues its upward trajectory after reaching new highs, outperforming its long-term average one-, three-, six-, and 12-months later. One year later, the S&P has risen 13 out of 14 times by a median of 13.4%.

- Some strategists are recommending that investors with notable gains, particularly in technology stocks, rebalance their portfolios in expectation of broader market participation in 2024.

- Source: Helios Quantitative Research, Bloomberg, Dow Jones, Fundstrat