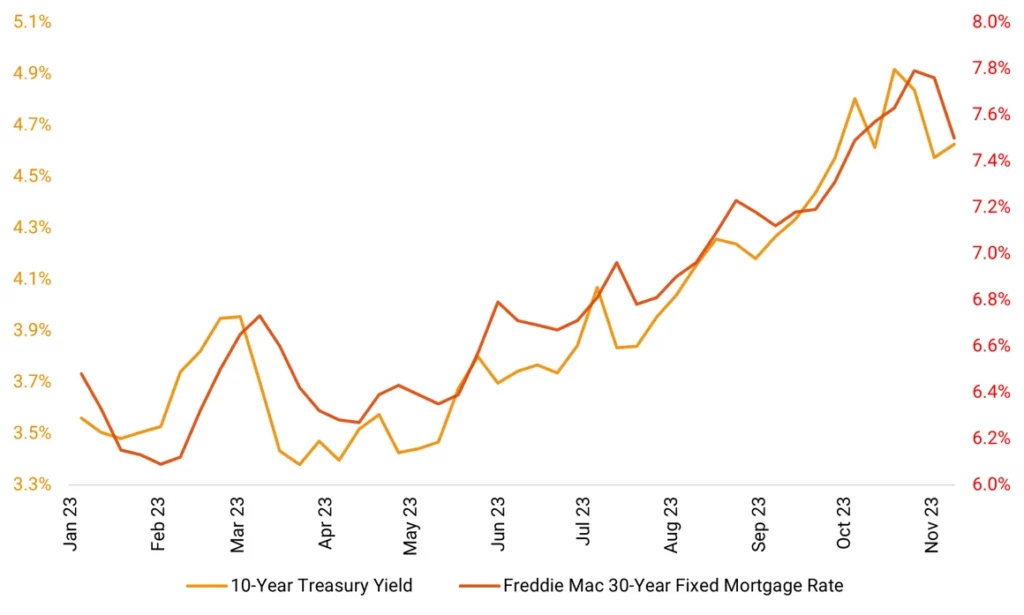

- Mortgage rates often move in tandem with Treasury yields, and the recent drop in the 10-year Treasury yield from its October peaks has precipitated a corresponding fall in the 30-year fixed mortgage rate.

- The chart illustrates this correlation, with changes in the 10-year Treasury yield typically preceding movements in the 30-year fixed mortgage rate.

- The average rate for a 30-year, fixed mortgage in the US fell to 7.5% last week, from 7.76% the prior week, according to Freddie Mac. This marks the lowest level since mid-October and the most significant one-week drop since last November.

- Despite this reduction, mortgage rates remain high, discouraging many homeowners from moving and contributing to low inventory and high prices.

- Capital Economics predicts that mortgage rates have peaked and expects a gradual decline over the next two years. However, they anticipate rates will remain above 6% until the end of 2025, significantly higher than the 2010s average of 4.1%. This is expected to continue affecting affordability and dampen any major recovery in housing activity.

- According to Freddie Mac’s chief economist, household debt is rising, driven by mortgages, credit cards, and student loans. This debt, coupled with the high cost of living, is straining consumers, leading to a potentially stagnant housing market unless mortgage rates decrease significantly.

Source: Helios Quantitative Research, Bloomberg, Freddie Mac, Capital Economics