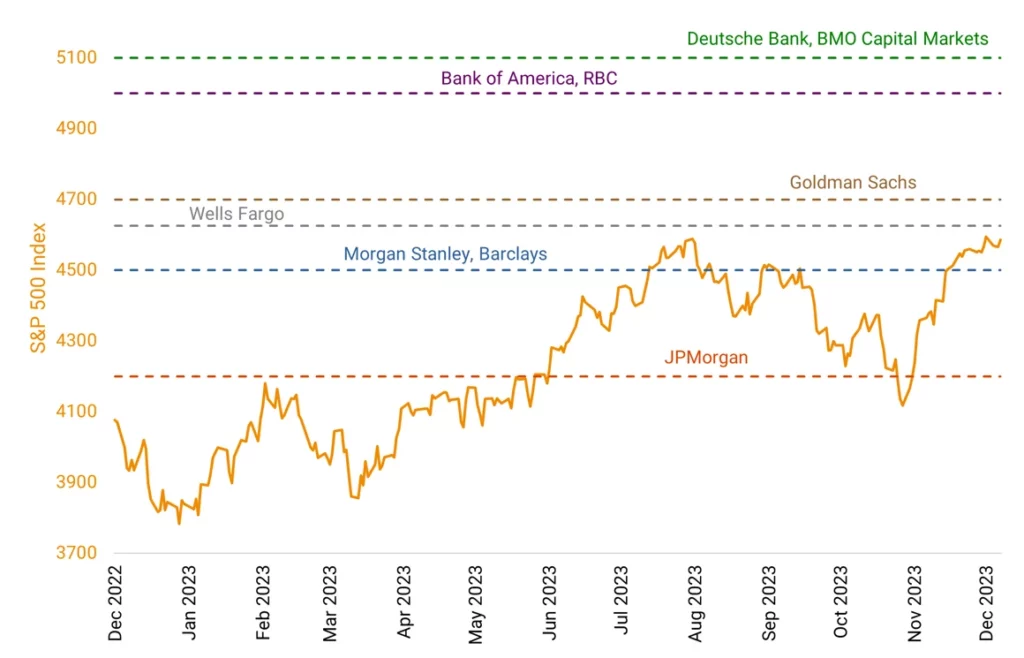

- Wall Street’s 2024 S&P 500 forecasts are a mixed bag of optimism and caution, with JPMorgan’s notably grim prediction standing out among its more bullish counterparts.

- JPMorgan predicts an 8% drop in the S&P 500 Index by the end of 2024, marking the most negative outlook among Wall Street firms. This forecast is based on factors like slowing global growth, decreasing household savings, and high geopolitical risks, including policy volatility from the upcoming national elections.

- JPMorgan’s prediction starkly contrasts with other Wall Street strategists, many of whom anticipate record highs for the S&P 500. Notable optimists include analysts from Bank of America Corp., Deutsche Bank AG, and Goldman Sachs Group Inc., with predictions of the index hitting or approaching 5,000.

- Despite bearish predictions for 2023, the S&P 500 has shown remarkable strength, surging over 19% (as of December 7) due to positive economic data, declining inflation, and expectations of the Federal Reserve slowing its rate hikes.

- While maintaining its pessimistic view for 2024, JPMorgan acknowledges potential earnings growth of 2-3% next year, setting a target of $225 earnings-per-share for 2024. This outlook remains cautious amid a backdrop of potentially prolonged high interest rates and overly optimistic consensus estimates.

- Source: Helios Quantitative Research, Bloomberg