- In their final meeting of 2023, the Federal Open Market Committee (FOMC) unanimously voted to keep interest rates unchanged at 5.25-5.50% but made dovish changes in their policy statement, indicating an end to the tightening cycle.

- The revised dot plot forecasts a lower path for the federal funds rate, with a decrease to 4.6% in 2024 (from 5.1% previously) and to 3.6% in 2025 (from 3.9%). This suggests a total of 175 basis points of cuts over the next two years, more than previously anticipated.

- Fed Chair Powell’s comments were in line with the dovish tone, indicating no further rate hikes and a focus on the timing of future rate cuts. He suggested that rate cuts could start before core inflation reaches the 2% target, potentially as early as March 2024.

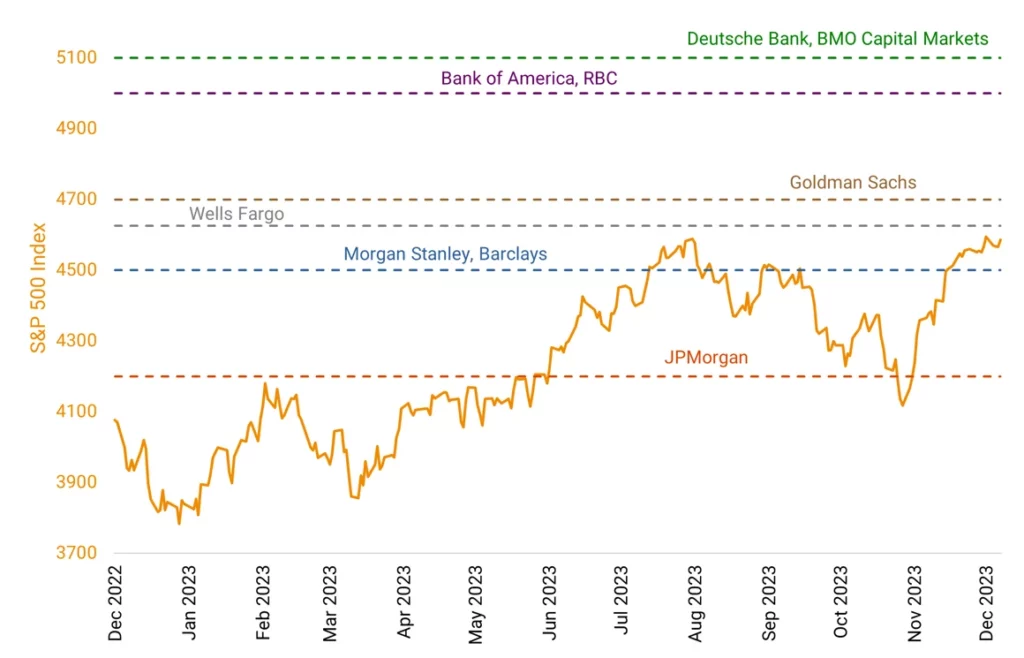

- The market responded positively, with Treasury yields falling, the S&P 500 rallying, and the US dollar weakening. Fed funds futures now indicate a higher likelihood of rate cuts in 2024.

- The FOMC’s stance and projections reflect a strong belief in a “soft landing” scenario, where the economy slows down without significant negative impacts.

- Source: Helios Quantitative Research, Bloomberg, Federal Reserve