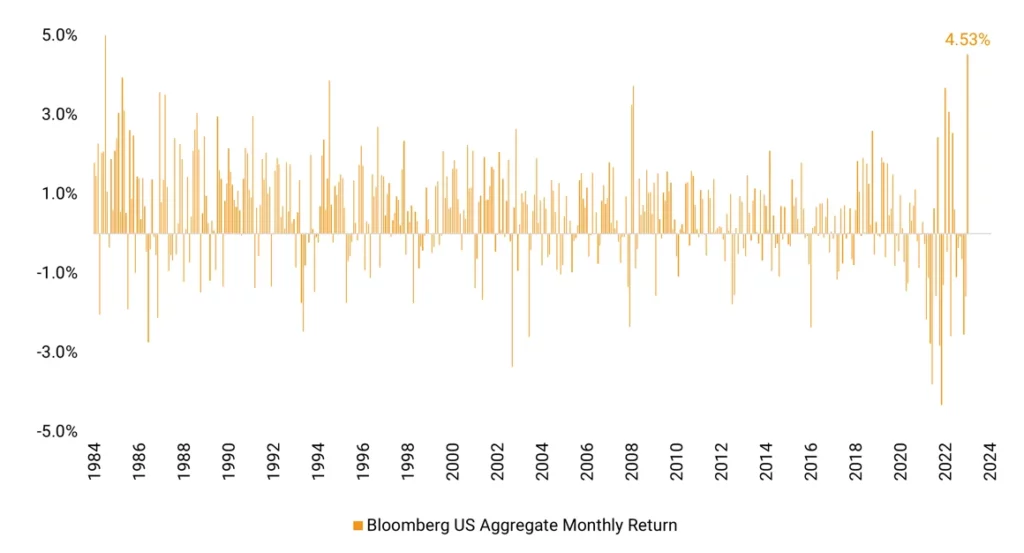

- Capping off a difficult year for bonds, November emerged as a historic month, marking the best performance for U.S. bonds since 1985.

- U.S. junk bonds had their most substantial rally since July 2022, increasing by over 4%, underscored by a record inflow of $11.9B into exchange-traded funds (ETFs) tracking this asset class.

- November was a standout month for debt markets globally, with a Bloomberg index of sovereign and corporate debt delivering its highest return since 2008, over 5%.

- This sparked an unprecedented rally across diverse markets, from stocks and credit to emerging markets.

- Last month’s yields exceeding 5% prompted active bond managers to increase their holdings in longer-term debt.

- Echoing this trend, a recent client survey by JPMorgan Chase & Co. indicated a continued rise in these investments, with a record 78% of surveyed active investors expanding their net long positions.

- Source: Helios Quantitative Research, Bloomberg, JPMorgan Chase & Co.