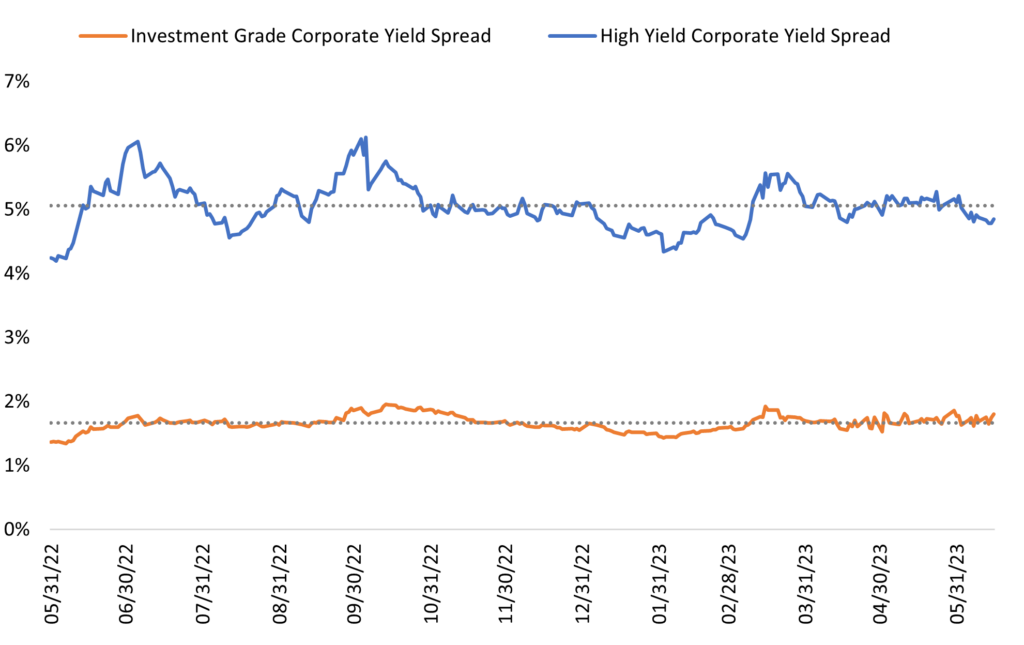

- Credit spreads indicate how much risk the market believes is in a given asset class and is the difference between the yield on Treasury bonds versus the yield on a given set of bonds.

- Spreads on high-yield corporate bonds have started to come down recently after they surged following the collapse of Silicon Valley Bank. The decline indicates the perceived risk among corporate balance sheets has lowered from where it was and has implications across capital markets if the worries facing corporate balance sheets and income statements are less significant now compared to a few months ago.

- While regional banks still face headwinds, regional bank indices and ETFs have started to rover in recent weeks, though they still are well below their pre-SVB collapse levels.

- SolutionsOpenClose

- Insourced CIOOpenClose

- Helios ToolsOpenClose

- Confidence Rating ProcessOpenClose

- Customized ModelingOpenClose

- Why HeliosOpenClose

- Getting StartedOpenClose

- Resources CenterOpenClose

- TeamOpenClose