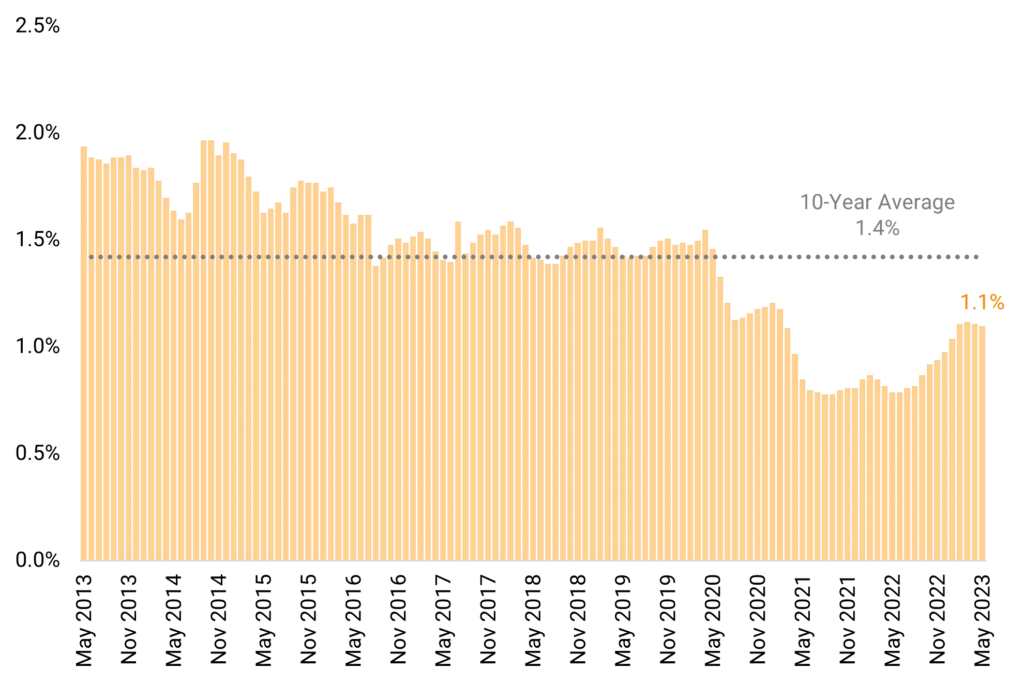

Source: Helios Quantitative Research, Bloomberg, Federal Reserve |

- SolutionsOpenClose

- Insourced CIOOpenClose

- Helios ToolsOpenClose

- Confidence Rating ProcessOpenClose

- Customized ModelingOpenClose

- Getting StartedOpenClose

- Resources CenterOpenClose

- TeamOpenClose