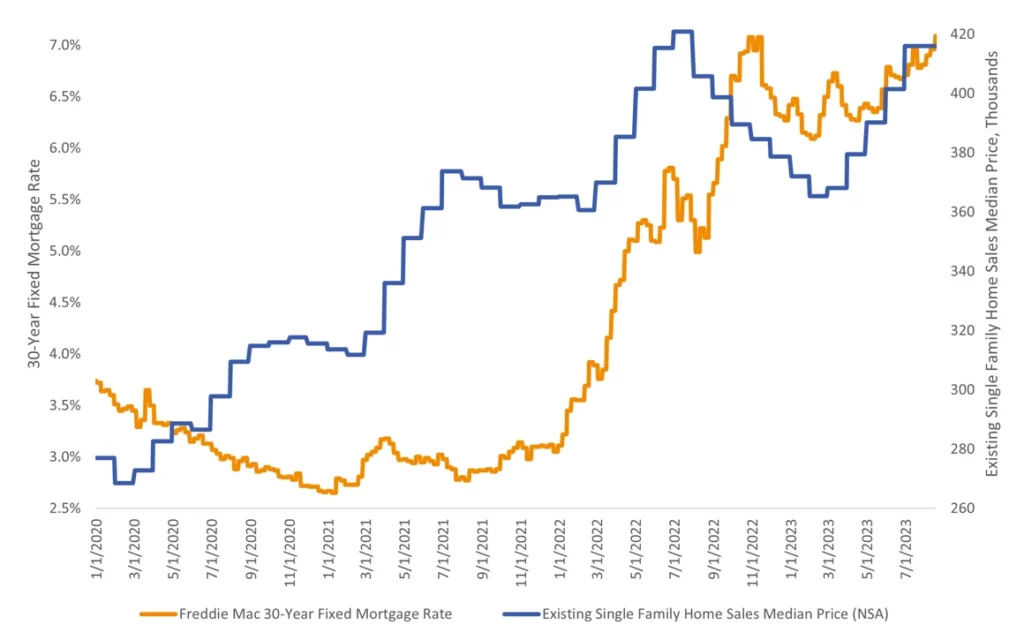

- With the recent surge in the 30-year fixed mortgage rate above 7%, affordability has plummeted to its lowest level since 1984. Tight inventory continues to impact existing home sales, with transactions dropping nearly 19% in June compared to the previous year.

- Some Economists believe housing prices will decline as rates surpass 7%, rendering affordability unrealistic and sideling many buyers, resulting in fewer transactions and eventually decreased prices.

- US Industrial production rose 1% in July, the most since the start of the year, after sliding 0.8% in June. Factory production also increased by 0.5%, the first increase in three months. A stronger-than-expected industrial production is usually a positive sign for stocks, but bonds generally prefer slower industrial production growth because it serves as a signal of moderating inflation.

- Headline retail sales rose 0.7% in July, exceeding the consensus estimate (0.4%) and the 0.2% increase in June.

- Initial jobless claims decreased by 11K to 239K for the week ended August 12, which may lead to a softer August payroll report. Continuing claims increased by 32K to 1,716K for the week ended August 5, surpassing the 2019 average of approximately 1700K, suggesting a potential tightening of the job market.

- Hong Kong’s benchmark Hang Seng index is in a bear market, down 21% from its January high, amid concerns that China’s real estate troubles will affect the broader economy.

Source: Helios Quantitative Research, Bloomberg, National Association of Realtors, Federal Reserve, Department of Labor