- Hotter-than-expected inflation may prompt the Federal Reserve to consider raising interest rates in November or December, after a likely pause this month.

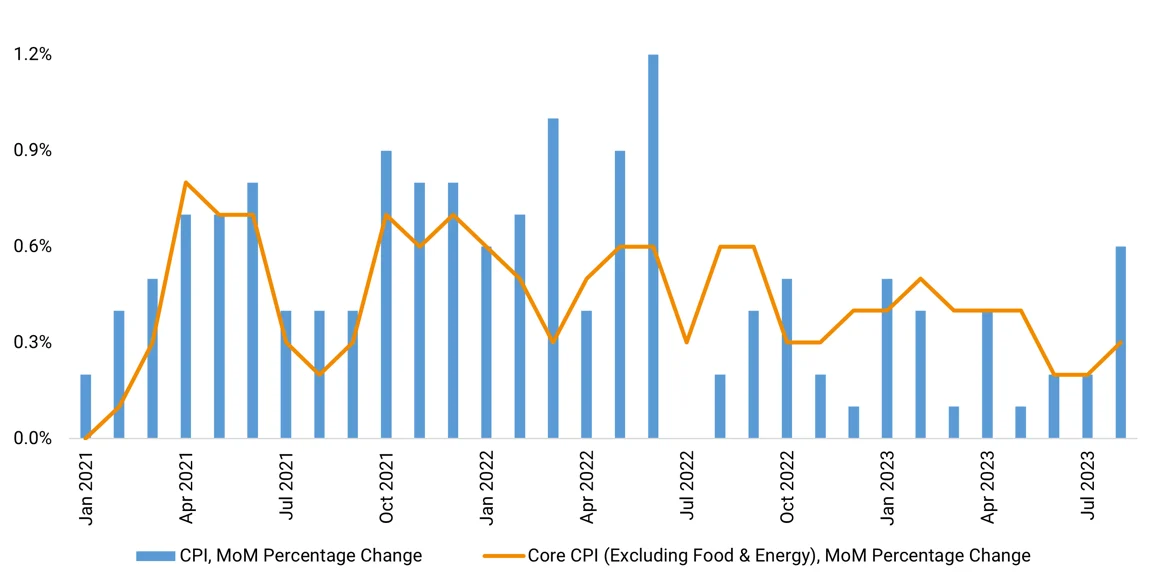

- The headline Consumer Price Index (CPI) rose 3.7% year-over-year and 0.6% from July, with higher gas prices accounting for over half of the increase in August.

- The core CPI, which excludes volatile food and energy costs, rose 0.3% last month, marking the first acceleration in six months. On a year-over-year basis, the core CPI increased by 4.3%, still above the Fed’s 2% target, yet marking the smallest increase in nearly two years.

- Investors anticipate the Fed will leave rates unchanged at the September policy meeting, while swap contracts suggest a 33% chance of a rate hike to a range of 5.5% to 5.75% in November.

Sources: Helios Quantitative Research, Bloomberg, Bureau of Labor Statistics