The eternal question that almost every investor wants the answer to, “Is now the right time to be buying equites?” For today’s answer we’re going to visit two algorithms that seek to understand opportunity in the equity market.

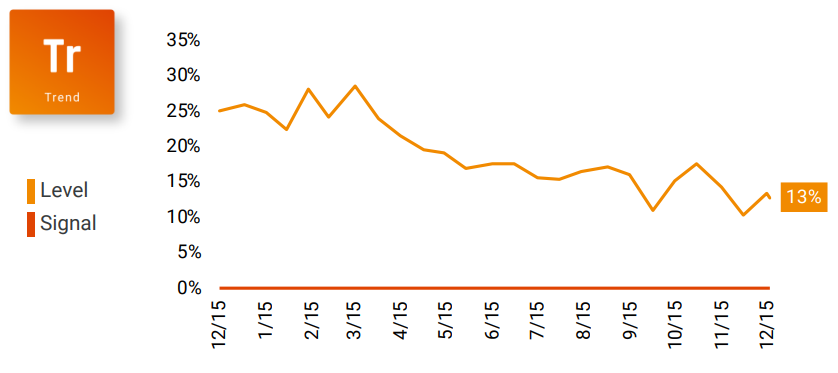

The first is our Trend Element which is a combination of both linear and geometric mathematics. We all know momentum is a powerful factor, and our data suggests that although trends have been coming down from the BIG runup in late 2020, equity markets are still showing great trend strength.

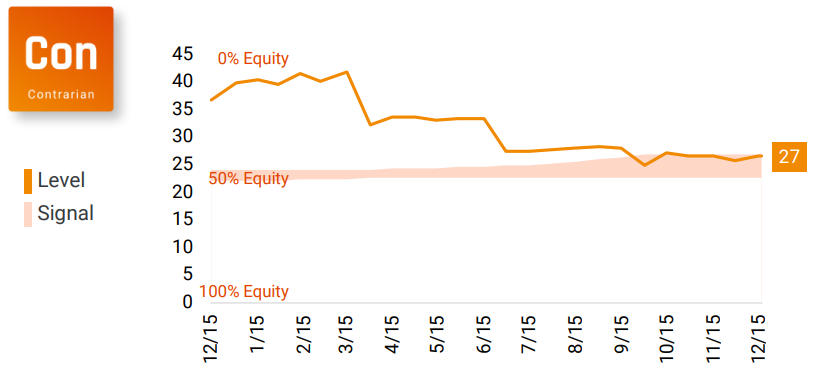

The second part of the answer is all about timing. If trends look good, what about NOW? For that we look to our Contrarian algorithm that seeks to use fundamental analysis to determine if markets are fairly valued. As you can see in the chart below, the effect of COVID-related stimulus pushed equities into a fundamentally overvalued range for a substantial period of time. However, with the recent market volatility and succession of a few good earnings seasons, the data would suggest we’re just getting into the area where now isn’t a bad time to deploy some of the cash sitting on the sideline.

So, there you have it. Is NOW the right time get investing in stocks?

Trends still look good and fundamentals suggest a better opportunity than most of the last year.

Want to learn more about Helios Quantitative Research? Click Here to schedule a meeting with one of our representatives! Have a great holiday season and a fantastic new year!