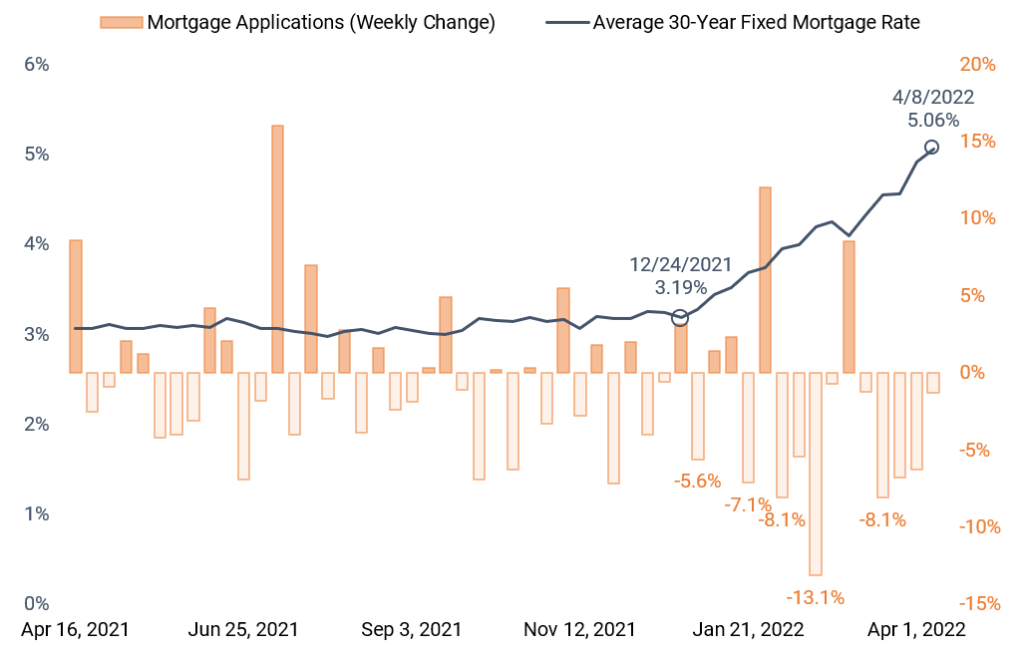

Mortgage rates have shot up this year, responding to quickly changing interest rates and expectations of action by the Fed. As the Federal Reserve begins to tackle inflation, consistently high inflation rates have pushed up rates across the bond world, including mortgage rates. Since Christmas last year, average rates on a 30-year fixed mortgage in the US have increased nearly 2 percentage points. Pushing the average to the highest since 2010.

The quick increase pushes up borrowing costs for prospective homebuyers, which typically would dampen a hot housing market by putting downward pressure on prices since fewer people can afford the same house, as they could have four months ago. However, in today’s hot housing market, the number of homes for sale has remained low, likely, at least partially lessening the impact of higher mortgage rates. However, we have seen a sharp downtick in people looking to refinance, though purchase applications, while off their peak, are showing initial resilience to the increased rates.

The Breakdown

Across the economy, prices and expectations are in the process of being reset. Naturally, this can make investors, and everyone else, a bit uneasy. Driving things home, these impacts are rippling through the housing market, which tends to be one of, if not the, largest assets investors hold. While trends never continue forever, home prices won’t be insulated forever, especially when sitting at all-time highs (1).

1. According to the latest S&P/Case Shiller US National Home Price Index through January 2022  Source: Helios Quantitative Research, Bloomberg, Bankrate, Mortgage Bankers Association

Source: Helios Quantitative Research, Bloomberg, Bankrate, Mortgage Bankers Association