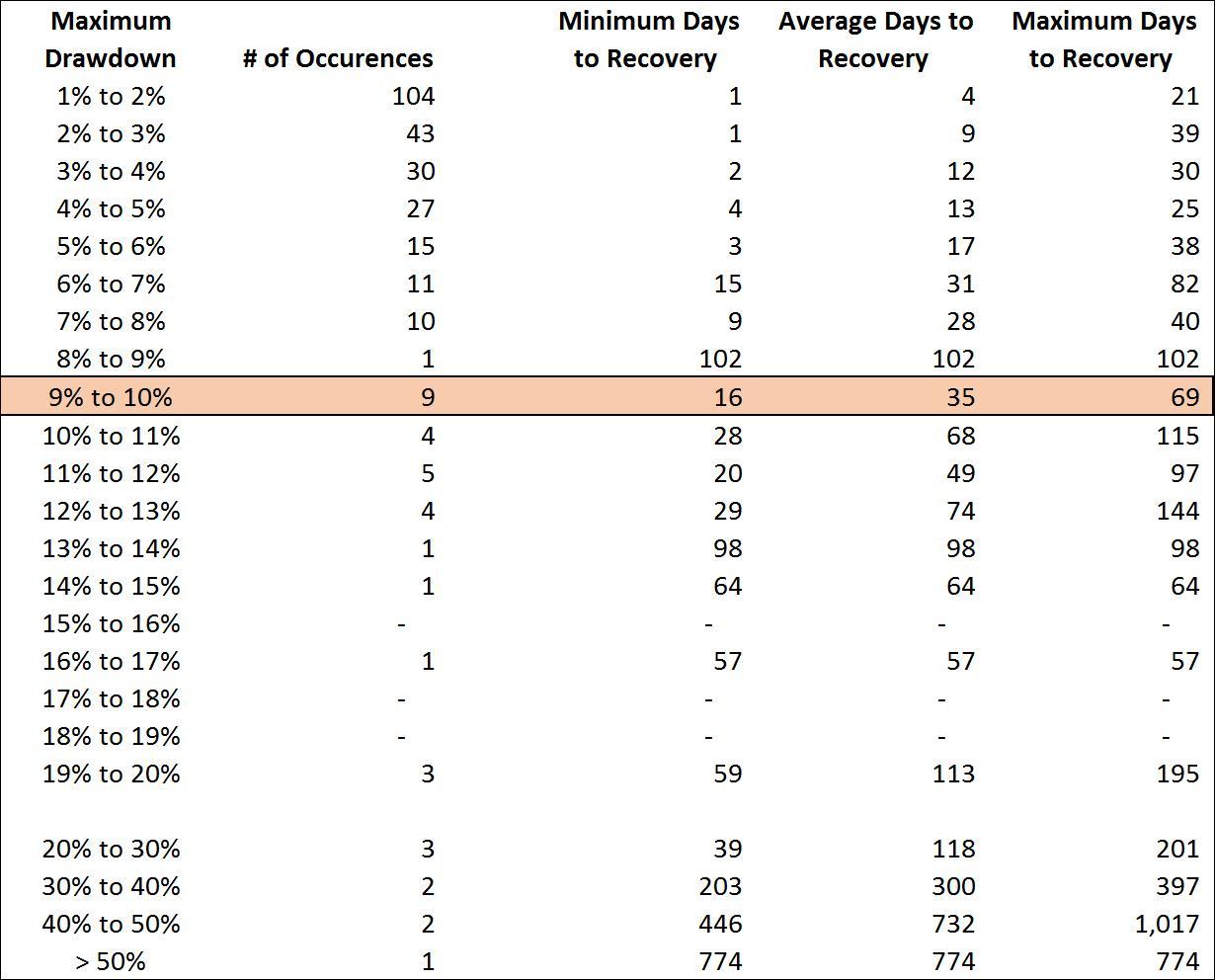

By Joe Mallen Recent market volatility has been driving the headlines with the October pullback on the S&P 500 Total Return Index exceeding 9% and inciting some anxiety among individual investors. While this is a natural reaction, it’s vital for investors to remember there’s no need to panic. Markets will fluctuate, and it’s not unusual for 5% or even 10% pullbacks to occur. The problem is every time a significant drop occurs, the pullbacks are exacerbated as financial pundits try to predict the next recession and high-frequency traders jump on trends. But the data just doesn’t support that a recession is near. We studied the S&P 500 Total Return Index going back to 1950 and the results were illuminating. During that time, a 9-10% decline has occurred nine times. Remarkably, it only took an average of 35 trading days for the market to recover the lost ground. In one case, a full recovery happened within only 16 trading days.  We recommend advisors stay the course on their investment strategy unless the data supports a long-term equity market drawdown. What we’re seeing now is just a pullback whose timing was not surprising. Mid-term election season tends to cause volatility in the market and investors are closely watching the Federal Reserve’s interest rate decisions, which certainly could be a factor in this case. But much of the same trepidation existed a month before, so why did the pullback happen when it did? The bottom line is although you can try to explain away a decline, sometimes it’s just natural market volatility and there’s no deeper explanation. Most of the relevant economic data points are still positive and support the notion of a strong long-term economic state. Nothing substantial indicates we’ll reach a negative GDP point anytime in the next few years. In other words, this isn’t another 2008. We do expect market volatility to remain at a heightened level through the end of the year. Despite significant support for markets, including strong earnings growth, a lot of headline news is distracting people from that underlying strength. By the beginning of next year, we think people will start returning to a normal view of the market and more fundamental factors will drive its performance. There are many catalysts for continued growth and few for a sustained drawdown. That doesn’t mean the market won’t pull back further or experience more sideways volatility in the near-term. We just don’t see anything that supports a recession between now and at least the end of 2019. Times like this provide the opportunity to emphasize our core philosophies. Volatility happens and we oppose knee-jerk reactions to it. Markets ultimately follow long-term cycles. The pullback we’re experiencing now is natural and not an indication we’ve entered a recessionary environment. We advocate removing the emotion from investing so it doesn’t detract from the long-term goals of an investment portfolio. At Helios Quantitative, our mission is to be data-driven and make the highest-probability bet at all times.

We recommend advisors stay the course on their investment strategy unless the data supports a long-term equity market drawdown. What we’re seeing now is just a pullback whose timing was not surprising. Mid-term election season tends to cause volatility in the market and investors are closely watching the Federal Reserve’s interest rate decisions, which certainly could be a factor in this case. But much of the same trepidation existed a month before, so why did the pullback happen when it did? The bottom line is although you can try to explain away a decline, sometimes it’s just natural market volatility and there’s no deeper explanation. Most of the relevant economic data points are still positive and support the notion of a strong long-term economic state. Nothing substantial indicates we’ll reach a negative GDP point anytime in the next few years. In other words, this isn’t another 2008. We do expect market volatility to remain at a heightened level through the end of the year. Despite significant support for markets, including strong earnings growth, a lot of headline news is distracting people from that underlying strength. By the beginning of next year, we think people will start returning to a normal view of the market and more fundamental factors will drive its performance. There are many catalysts for continued growth and few for a sustained drawdown. That doesn’t mean the market won’t pull back further or experience more sideways volatility in the near-term. We just don’t see anything that supports a recession between now and at least the end of 2019. Times like this provide the opportunity to emphasize our core philosophies. Volatility happens and we oppose knee-jerk reactions to it. Markets ultimately follow long-term cycles. The pullback we’re experiencing now is natural and not an indication we’ve entered a recessionary environment. We advocate removing the emotion from investing so it doesn’t detract from the long-term goals of an investment portfolio. At Helios Quantitative, our mission is to be data-driven and make the highest-probability bet at all times.

- SolutionsOpenClose

- Insourced CIOOpenClose

- Helios ToolsOpenClose

- Confidence Rating ProcessOpenClose

- Customized ModelingOpenClose

- Why HeliosOpenClose

- Getting StartedOpenClose

- Resources CenterOpenClose

- TeamOpenClose