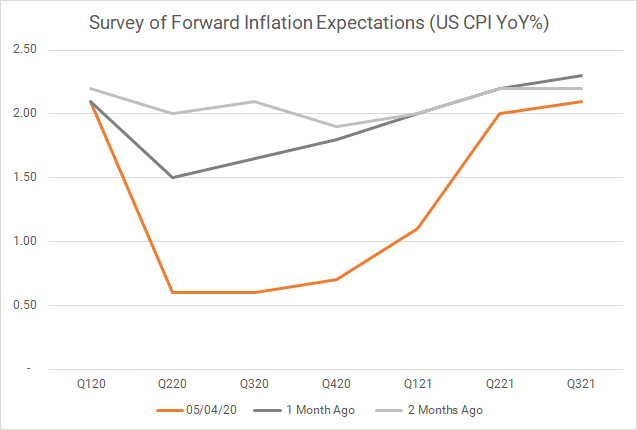

The U.S. economy contracted by 4.8% in Q1, the largest hit since the global financial crisis, and ending the longest expansion on record. The Q1 GDP report signals that we are likely in a technical recession unless output increases at a miraculous pace during May and June of Q2. Underlying the headline numbers, consumer spending fell 7.6%, which was the biggest drop since 1980 and business fixed investment fell by 8.6%, while residential investment (which has a longer pipeline and the shut down wouldn’t be fully reflected in the Q1) was up 21%, boosting the otherwise terrible figures. All eyes turn to Q2 forecasts, which are almost universally negative, with widely ranging estimates, with consensus estimates at -26% at this point. As expected, the Fed kept interest rates at the zero lower bound on Wednesday. No new programs were announced but noted it was ready to deploy additional measures if needed, and the ongoing crisis is likely to weigh on the economic outlook over the medium-term. As even the largest companies are trying to limit cash burn and protect their balance sheets, Shell announced a cut to its dividend, the first time since the second world war, and Exxon posted its first quarterly loss in over three decades. This comes amid cratering energy demand and oil briefly dipping into negative territory on April 20th. The Eurozone economy shrank at the fastest pace on record, falling 3.8% in Q1 as the ECB increased its lending to banks at ultra-low (even negative) rates in an attempt to improve access to capital and avoid freezing of the credit and capital markets. In some semi-positive COVID news, a promising result in an NIH study on Remdesivir helps buoy markets on Wednesday. However, a conflicting study in a top medical journal claimed the drug did not improve outcomes in the first randomized clinical trial on the drug.

- SolutionsOpenClose

- Insourced CIOOpenClose

- Helios ToolsOpenClose

- Confidence Rating ProcessOpenClose

- Customized ModelingOpenClose

- Why HeliosOpenClose

- Getting StartedOpenClose

- Resources CenterOpenClose

- TeamOpenClose