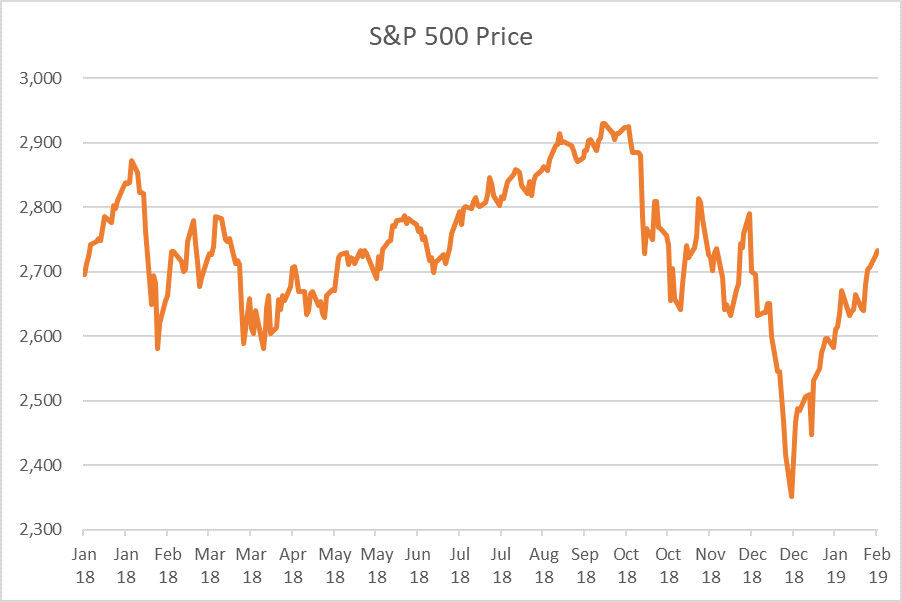

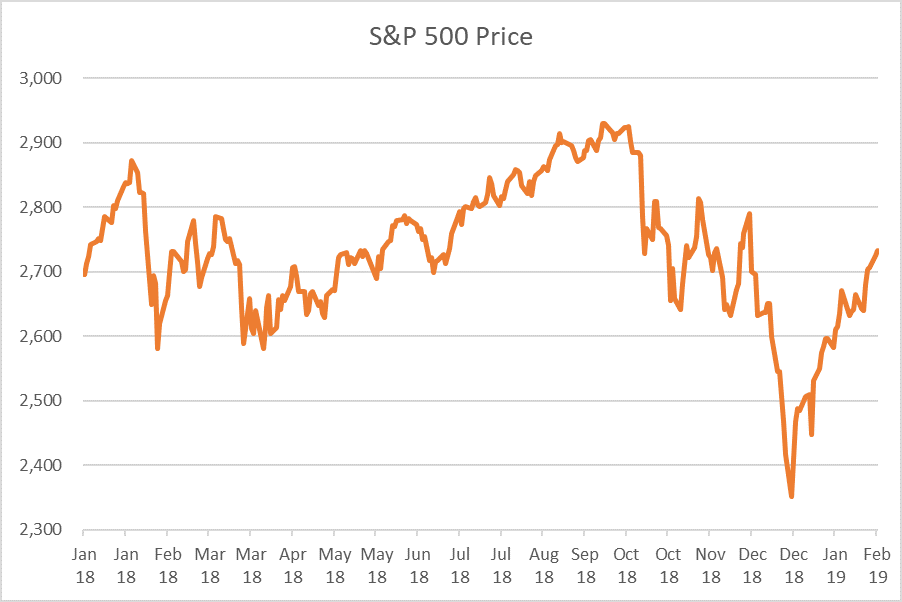

The fourth quarter was brutal for the markets, and while you may want to put those challenges in the rear-view mirror, the primary drivers that caused the drastic market fall at the end of last year are still incredibly relevant right now:

- Fed uncertainty – Q4 prompted increased concern surrounding how the Fed would act on rates, particularly as the yield curve flattened.

- Trade war concerns – The ongoing trade war with China showed no signs of being resolved.

- Gridlock in Washington – Major issues in Washington like the government shutdown, policy uncertainty and new control of the House of Representatives further exacerbated an already unstable market.

The drawdown began last October when the initial scare set in about the direction the economy was going. The Nasdaq saw its biggest monthly drop since 2008, while the S&P 500 experienced its worst month since 2011 and the Dow plunged to its lowest level since 2016. The volatility continued right through November, and the market fell off a cliff in December as those three catalysts came to light.  Where we are now Now in February, we are seeing a retracing of what happened late last year, but the uncertainty is starting to ease. We’ve gotten some clarity on the Fed as it’s taken a more dovish tone and we’ve received positive news in regard to trade talks with China, though nothing concrete. We’ve also resolved some of our fears as the government shutdown ends, at least temporarily, providing some relief. Portfolio moves for early 2019 The reality is, we’re living in an era where headline risk will continue to drive volatility in the markets, so focusing on the long term is key. There are a few moves advisors can make for clients right now:

Where we are now Now in February, we are seeing a retracing of what happened late last year, but the uncertainty is starting to ease. We’ve gotten some clarity on the Fed as it’s taken a more dovish tone and we’ve received positive news in regard to trade talks with China, though nothing concrete. We’ve also resolved some of our fears as the government shutdown ends, at least temporarily, providing some relief. Portfolio moves for early 2019 The reality is, we’re living in an era where headline risk will continue to drive volatility in the markets, so focusing on the long term is key. There are a few moves advisors can make for clients right now:

- Be selective with fixed income: When it comes to fixed income, advisors are wise to be selective, avoiding high-yield bonds and bank loans. Anything credit-linked is going to show volatility.

- Look for strength in the U.S.: In terms of the equity side, we at Helios take a contrarian view: We’re still believers in the United States. There is less stability in Europe and other developed international markets, and the prospects for growth are stronger in the U.S.

- Find opportunities to diversify: This may be a good time to rebalance and reevaluate portfolios and ensure clients are taking on an appropriate level of risk, as diversification was truly the hero of the fourth quarter.

Looking ahead We predict the economy will be shaky for a while, but regardless of what happens, it’s more important than ever to ensure your clients remain non-emotional about their investments. Implement a process, follow it and let it do what it’s supposed to.