Let’s talk about Treasury Yields! The Bond Market Doesn’t Believe the Fed  What’s happening: The 2-year treasury yield has fallen from its peak of 4.72% to 4.23% as of January 23, 2023.

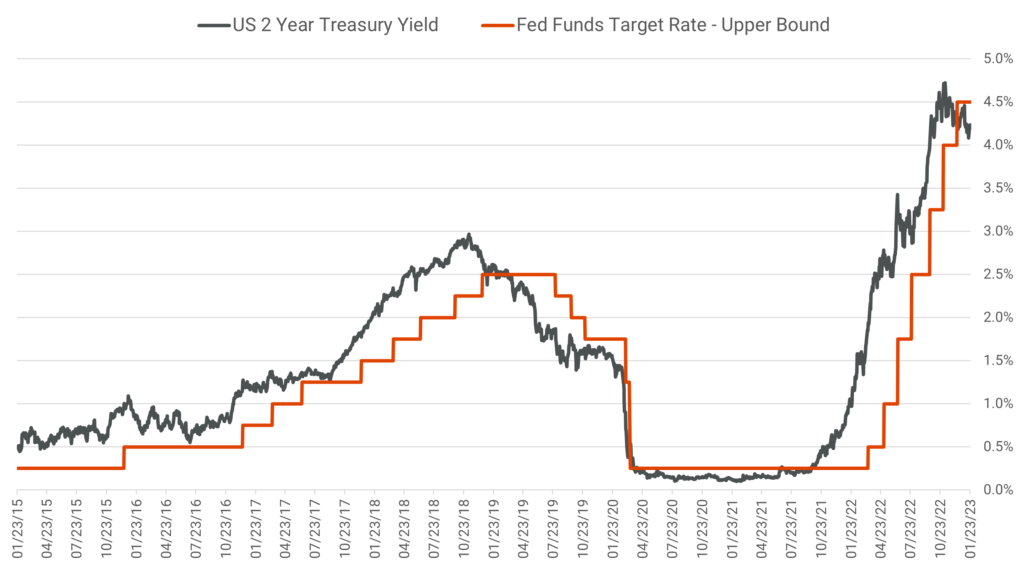

What’s happening: The 2-year treasury yield has fallen from its peak of 4.72% to 4.23% as of January 23, 2023.

Why that’s interesting: The yield on 2-year treasuries has long been viewed as a leading indicator for the Federal Funds rate. The last 8 years have confirmed this view. As you can see on the chart, the 2-year yield tends to move in advance of the Fed’s upper target rate.

What’s next: Presently, there appears to be a break in that relationship. Based on the Fed’s rhetoric, they intend to hike rates two more times to combat inflation – which would indicate a yield of 5%. However, the chart indicates the Fed will be reducing rates shortly. Is this a short-term disconnect or an indication the market thinks the Fed is much closer to cutting rates than industry pundits are forecasting? We’ll know in a few days.

Source: Helios Quantitative Research, Bloomberg