Let’s talk about yields!

Treasury Yields

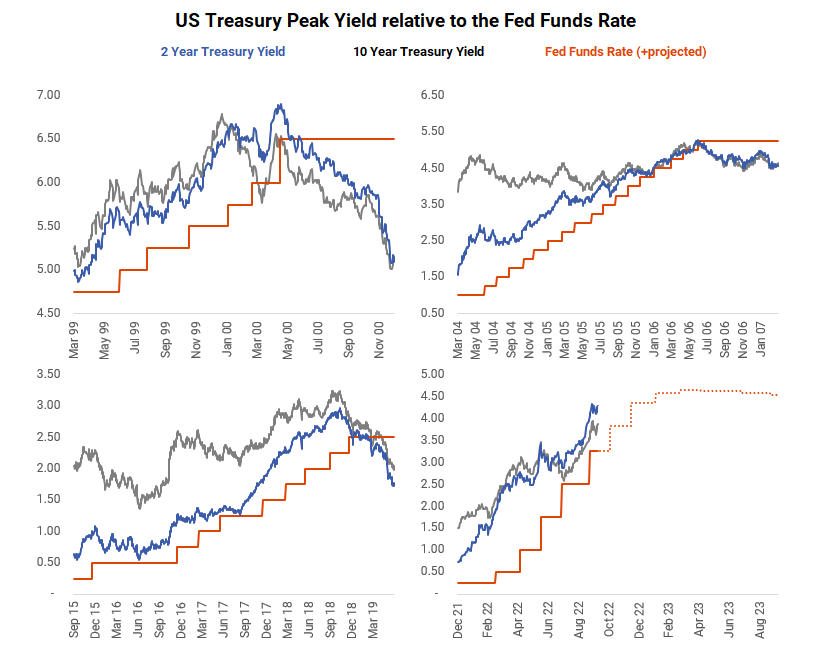

Naturally, US treasury yields increase during periods of Federal Funds rate increases. We see, that during the last four cycles, the yields on 2-year treasury notes and 10-year treasury bonds moved mostly in lockstep with the Fed Funds rate.

Naturally, US treasury yields increase during periods of Federal Funds rate increases. We see, that during the last four cycles, the yields on 2-year treasury notes and 10-year treasury bonds moved mostly in lockstep with the Fed Funds rate.

The peak yields occurred very near or slightly before the Federal Reserve stopped raising its benchmark rate.

We also observe the minimum yield curve inversion between the 2 & 10-year was at the same time. 2018 didn’t have an inversion but rather a nearly flat yield curve. In each case, the Federal Reserve paused its tightening when the economy showed signs of significant weakness.

If we extrapolate the previous three cycles to today, we expect the 2- & 10-year yields to peak on or before the final Fed Funds rate increase. Current futures markets expect that to be in early 2023.

If this story plays out as described, bonds may have poor returns through year-end but rebound quickly after the Federal Reserve pauses rate hikes. The period immediately after may be a strong market for bonds if history is any indication.

Source: Helios Quantitative Research, Bloomberg