Let’s talk about returns!

Nowhere to Hide?

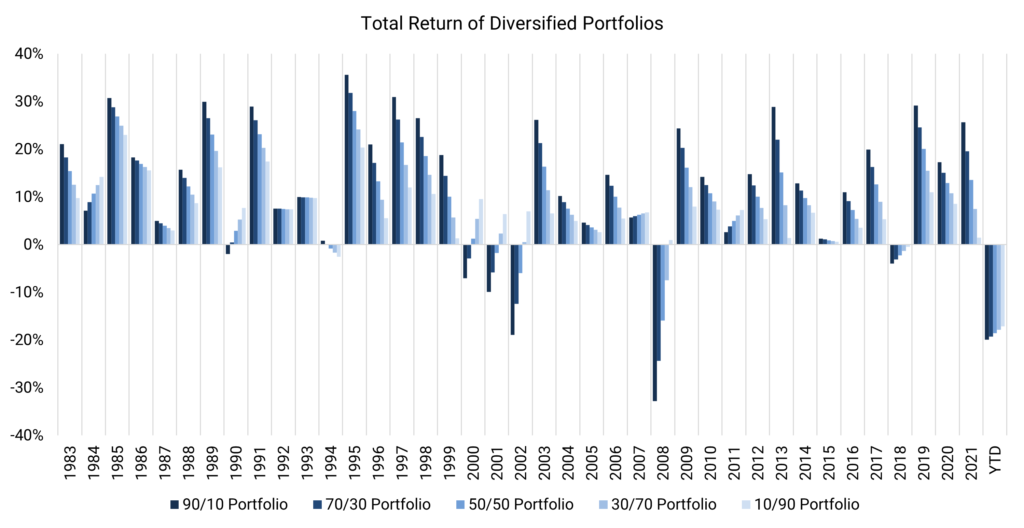

Diversified portfolios, represented by the S&P 500 Total Return Index and the Bloomberg US Aggregate Total Return Index, collectively have had very negative returns year-to-date. Aggressive to conservative portfolios are down between 17% and 20%.

If the year were to end today, this would be the second time in the past 30 years that all five risk levels finished negative (2018).

It is not uncommon to have significantly negative years for equities, but it is uncommon to have both significantly negative years for equities and bonds concurrently. In 2008, the pullback in equities was somewhat ballasted by bonds.

Source: Helios Quantitative Research, Bloomberg