Let’s talk about the Fed!

Fed Policy Pivot?

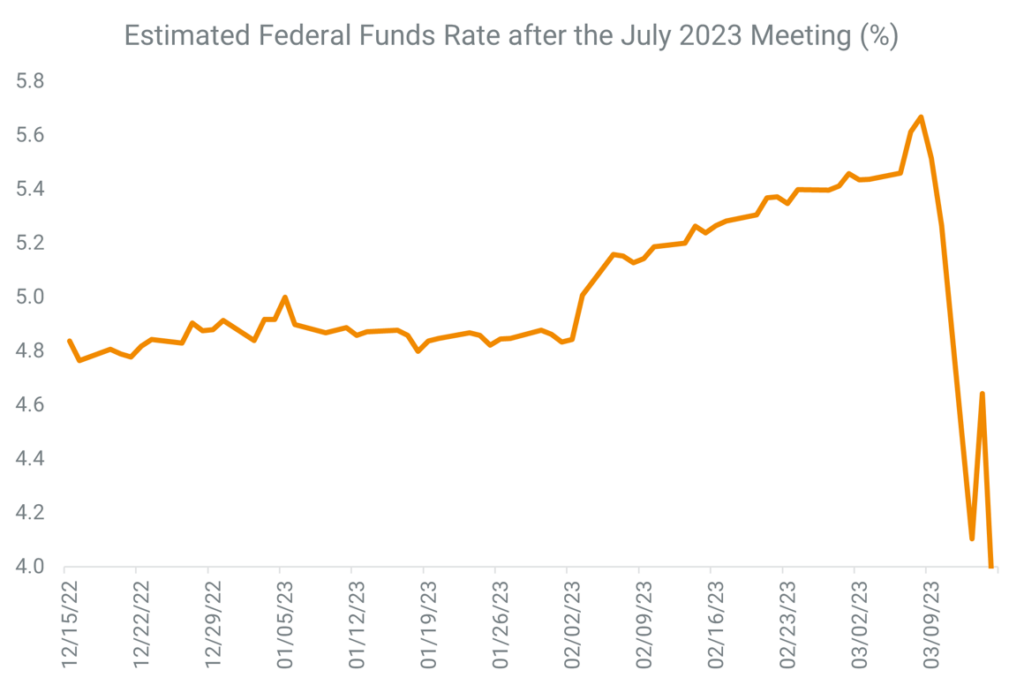

- The chart shows the estimated Federal Funds Rate after the July 2023 meeting. Over time, the expectation of what interest rates will be has crept up as actual interest rates have increased.

- A couple of weeks ago, Chairman Powell indicated interest rates might go higher than previously expected. This caused a small spike in the chart’s more recent data and volatility in the stock market.

- However, after Silicon Valley Bank failed, expectations of future rate levels fell precipitously. These lower expectations reflect the market’s sentiment that the economy is in deeper trouble than the Fed realizes, and they will be forced to cut interest rates.

- This data is fast-moving and could change substantially from here, but it highlights the disconnect between the latest Fed comments and what the market believes.

Source: Helios Quantitative Research, Bloomberg