- Failures at Silicon Valley Bank and Signature Bank prompted the Fed, Treasury Department, and the FDIC to step in to protect depositors, backstop the banking system and reassure the public that their money was safe in the nation’s banks last week.

- This week’s solvency concerns at Credit Suisse and First Republic created additional volatility across the banking system.

- The Federal Reserve called an “expedited” closed-door meeting for Monday, with the discount rate on the agenda, suggesting that the chaos in the banking system has called the Fed’s intention to raise interest rates into question.

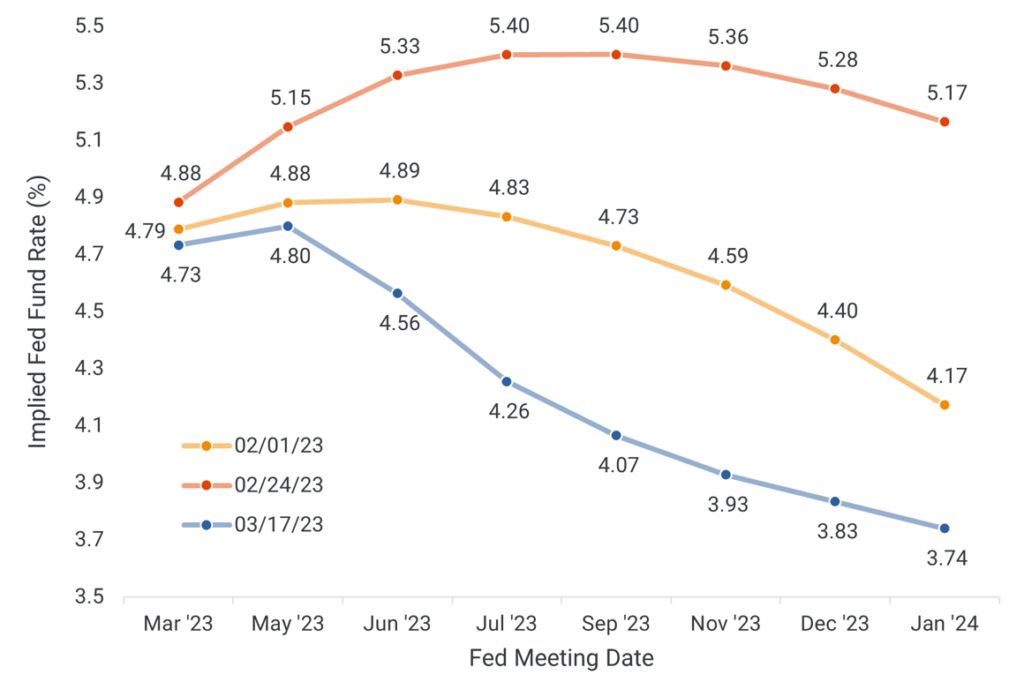

- Traders have downshifted their expectations for the path of the Fed’s anti-inflation rate hike campaign as a result. Market participants on Friday mostly expected the Fed to hike its benchmark fed funds rate a quarter-point at its March 22 meeting, a retreat from the half-point hike traders anticipated last week.

- As measured in January 2024, the anticipated terminal rate currently sits at 3.74%, a 1.43% decrease from slightly over a month ago.

Source: Helios Quantitative Research, Bloomberg