- On March 22nd, the Fed raised interest rates another 25 basis points, making it the ninth consecutive rate hike and putting the policy rate at its highest level since 2007.

- With turmoil impacting the global banking industry, there are fears of the Fed possibly worsening the situation if they were to keep its aggressive stance much longer and the impact it could have on the overall economy.

- With economic concerns looming, the US yield curve has remained inverted, and now the entire US yield curve is below the upper bound of Fed policy.

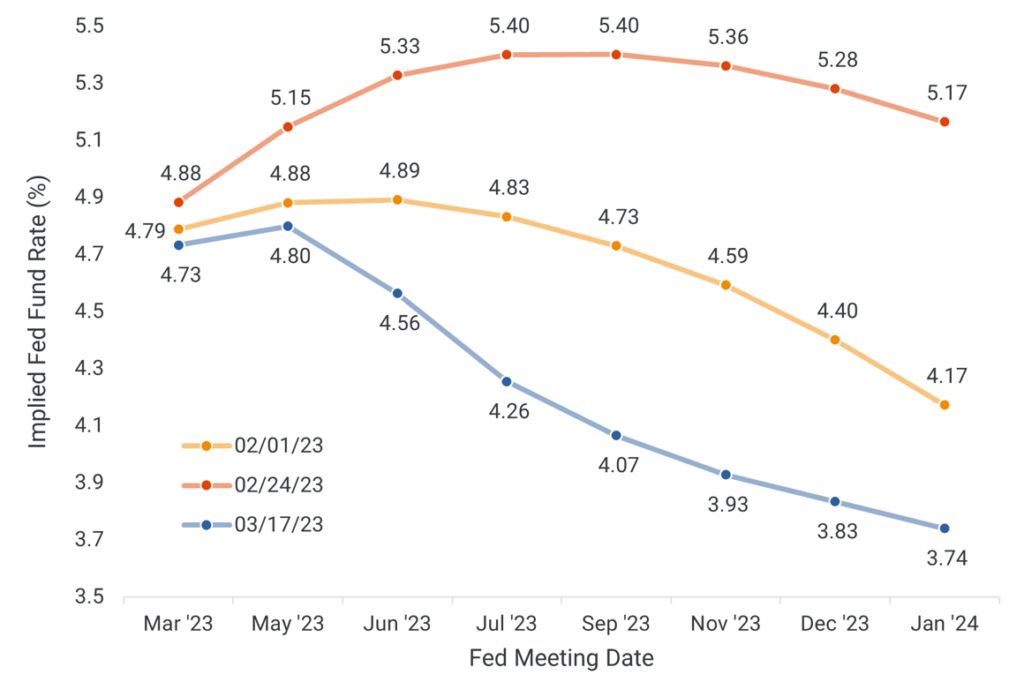

- The Fed has been in a difficult position for a while and has so far maintained an aggressive stance to combat inflation. However, with the collapse of Silicon Valley Bank, and the wider concerns in the banking sector, they are in an even more difficult position today. Economic concerns continue to grow, and the bond market is signaling it believes the Fed will have to change course later this year.

- SolutionsOpenClose

- Insourced CIOOpenClose

- Helios ToolsOpenClose

- Confidence Rating ProcessOpenClose

- Customized ModelingOpenClose

- Why HeliosOpenClose

- Getting StartedOpenClose

- Resources CenterOpenClose

- TeamOpenClose