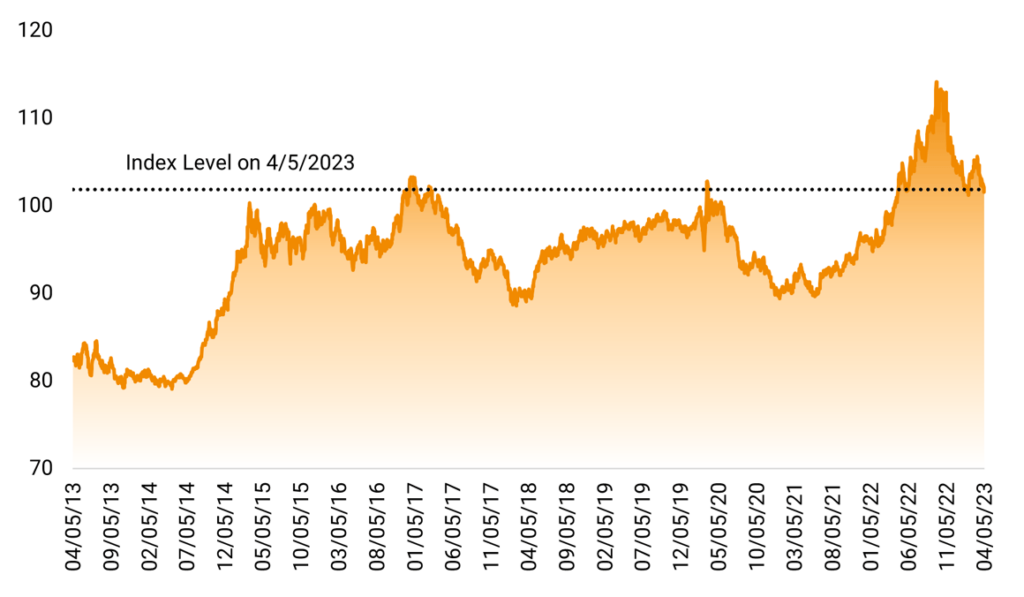

- The US Dollar Index is a barometer for the dollar’s overall strength compared to a basket of other major world currencies. Since its recent high on September 27th, it has fallen by over 10%, prompting some handwringing from pundits on the secular decline of the dollar.

- While the decline has been relatively quick, it has only brought down the value of the dollar to levels not seen since… last June. Then, fueled by a Fed that was more aggressive than other central banks, the dollar experienced a hockey stick-shaped surge of nearly 28% from early 2021 until the peak last September.

- Even after the pullback, you need to go back over 20 years to the very early 2000s to find a meaningful amount of time when the dollar was stronger.

- Further fueling the speculative fire is recent headlines of the first yuan-denominated natural gas contract as well as out of Russia claiming the BRICS countries are supposedly working on an alternative currency to the US Dollar or Euro. While these headlines can make for juicy headlines, they are little more than drops in the buckets in the overall scheme of things when looking at the role the dollar plays in the global economy.