The Most Important Thing Today (4/5/23)

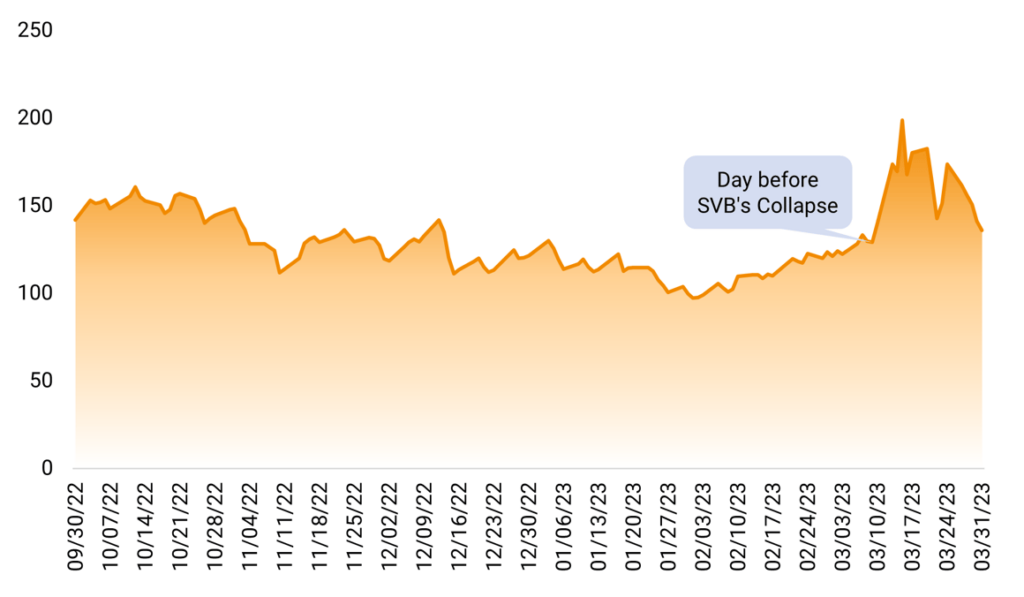

Let’s talk about banks! Fears of Contagion in the Banking Sector Begin to Fade March has been a wild ride in both investor sentiment and market volatility following the collapse of Silicon Valley Bank on March 10th. Following the collapse, expected volatility on Treasury bonds rocketed upwards and sharply adjusted and readjusted in the following days and weeks. A stream of news continued about weakness in other banks, such as First Republic, along with Credit Suisse needing to be rescued by UBS. For much of the rest of the month, investors scrambled to figure out how widespread the […]