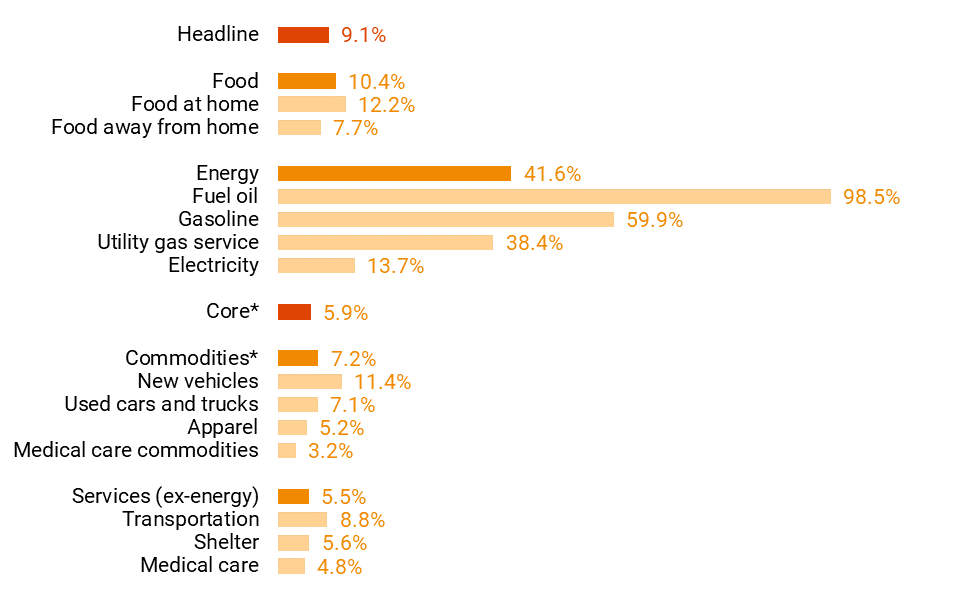

Lets talk about inflation!  * Excludes food and energy

* Excludes food and energy

Source: Bureau of Labor Statistics, Bloomberg, Helios Quantitative Research

Hitting the highest level since 1981, the Consumer Price Index (“CPI”) jumped to 9.1% in June. Estimates were for an increase of 8.8%.

The stock and bond markets were largely unscathed by the CPI data release, as the focus has shifted to the Federal Reserve’s path for interest rates beyond 2023. If a recessionary environment surfaces, many expect that a period of increasing rates could quickly revert to a period of decreasing rates. This creates a strange dichotomy whereas poor economic data may be positive for equity markets.

The year-over-year increase in energy and food clearly impacted the data. The war in Ukraine and ongoing supply chain issues contributed to the spike in prices through June. However, many energy commodity prices have fallen significantly since the start of July.

Many view this reading as potentially the peak in inflation, as evidenced by the falling energy prices in July. Unsurprisingly, the odds of a 100-basis point hike at the July 27th Federal Reserve meeting jumped to 30% as of Friday, July 15th. The data heavily suggests a 75-basis point hike.

Want to learn more about Helios Quantitative Research? Click Here to schedule a meeting with one of our representatives!