Let’s talk about labor!

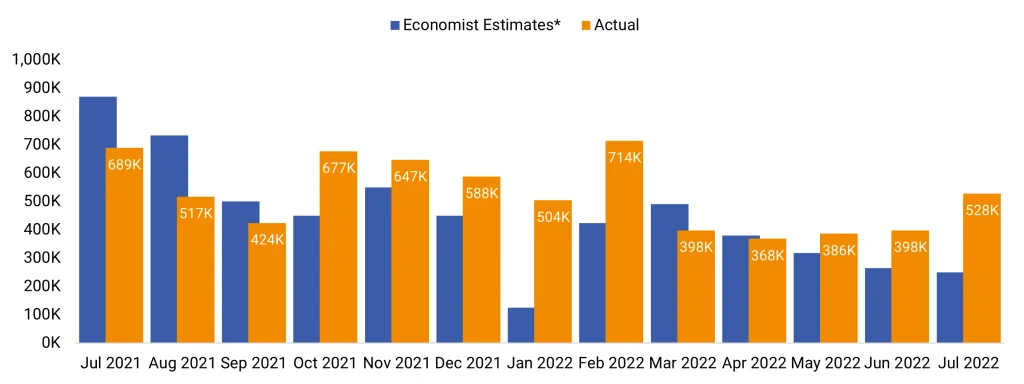

Source: Bloomberg, Bureau of Labor Statistics

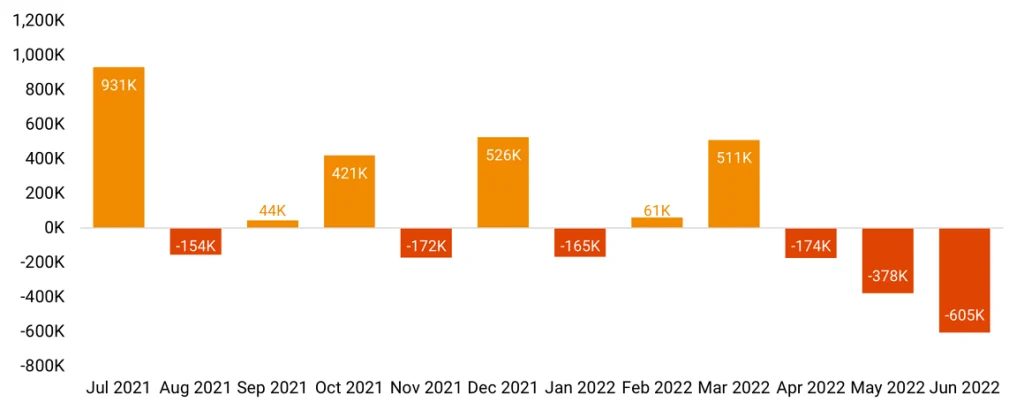

Source: Bloomberg, Bureau of Labor Statistics

Consumers, boosted by a labor market, have been in the driver’s seat in this economy, but the question has been how long the labor market can stay hot, especially with the Fed attempting to tamp down inflation by cooling the economy.

So far, the labor market doesn’t appear to be slowing down with July marking the third straight month of job gains surpassing expectations.

New jobs more than doubled economists’ expectations in July, with the economy adding 528 thousand new jobs versus the 250 thousand that was the median forecast according to a Bloomberg survey. However, the Fed may be having an impact on job openings, which have fallen in April, May, and June.

However, despite the three months of losses, total job openings continue to run at high levels following the skyrocketing need for employees coming out of the pandemic.

On one hand, a continued strong labor market makes a near-term recession less likely (or at least dampens a potential recession) and may increase the nearly impossible task of the Fed pulling off a soft landing. On the other hand, it also makes tamping down inflation that much harder.

Source: Helios Quantitative Research, Bloomberg, Bureau of Labor Statistics