Here we are at the beginning of 2022 and anyone who knows anything about the economy and markets have one burning question: Where is inflation going? That one simple answer would provide tons of information on what to expect from the Fed, interest rates, and supply chains. Heck, with that answer we’d also know a ton about the direction of everything from global food shortages to crypto. Needless to say, this answer is a big deal.

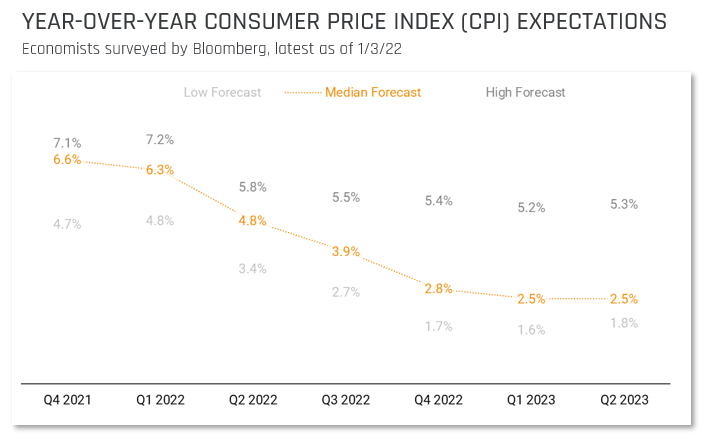

Bad news though… no one has the answer, but perhaps there is directional wisdom in looking at a large swath of economists to gauge the high/low/median of inflation expectations. The chart below summarizes the expected data ranges of inflation into 2023.

You can see the collective brainpower of economists believe YoY inflation has already peaked in Q4 2021 or will be peaking in Q1 2022. At that point, the data is expected to begin normalizing on a YoY basis due to the comparative numbers from a year ago and easing supply chain issues. Many markets have already begun to reflect this chart. Examples include the S&P reaching new all-time highs and crypto markets (often used as an inflation hedge) have dramatically sold off.

Where does this leave the Fed? The answer is full steam ahead. Inflation has remained alarmingly high despite initial agreement that inflation would be transitory. We expect the Fed to wrap-up the tapering program in Q1 (Q2 at the latest) and begin manually raising short-term interest rates up to 3 times in 2022. The result will be an obvious pressure on bonds like Treasuries and potential risk to equity markets as access to credit gets more expensive for companies. It’s obvious to us that systematic (not emotional) risk management will be critical in 2022.

Want to learn more about Helios Quantitative Research? Click Here to schedule a meeting with one of our representatives!