Four Ways to Streamline Client Portfolios: How Helios Can Help

Creating a smoother, more efficient investment management workflow can give your practices huge advantages. It can free up valuable time, decrease...

Helios helps financial advisors simplify and scale their investment process through a combination of quantitative research, portfolio oversight, and advisor enablement tools. Our model is built around two distinct levels of service — Premium Research Services and Investment Committee Services — designed to fit where your practice is today and grow with you over time.

Whether you prefer to leverage Helios’ data-driven models or partner with us as your fractional CIO, our goal is the same: to improve the odds of achieving your clients’ financial plans through disciplined, fact-based portfolio management.

The Helios Confidence Rating process analyzes over 40,000 ETFs, mutual funds, and stocks so you don't have to!

Deploy a fully customized, quantitative model ecosystem that's easily implemented for your clients.

Access Helios' portfolio design approach that optimizes client portfolios - even between service meetings!

Engage clients with data-backed reports and white-labeled communication that strengthens your message.

Simplify and streamline your compliance documentation while reducing your business risks.

Let Helios handle everything from automated model rebalancing to cash management for your practice (RIA's only)

Helios partners with advisors, RIAs, and institutions seeking a scalable investment framework backed by research, data, and ongoing oversight. Whether you’re building portfolios in-house or looking to delegate CIO responsibilities, Helios provides the structure and flexibility to fit your model — helping you deliver consistent results to your clients.

Helios enables fully customized portfolio capabilities for liquid assets to help you manage complex clients.

Helios can serve as an end-to-end partner that delivers everything your practice needs to manage client assets.

Helios empowers RIA's to maximize their independence and deliver cutting edge asset management solutions.

Helios enables Independents to stay true to their compliance rules while providing differentiated capabilities.

Helios is proven to help Advisors quickly gather AUM from existing client relationships.

Helios provides the systems and processes that help separate your RIA from the pack.

Helios delivers a systematic approach to asset management the provides a solid compliance foundation.

Helios provides quantitative solutions that help advisors grow, scale, and strengthen their value proposition. Explore how we support every stage of advisory practice development — from differentiation to operational efficiency and long-term enterprise value.

.png?width=258&height=145&name=Helios%20Web%20Images%20800x450%20(9).png)

How Advisors Can Use Market Commentary to Strengthen Client Relationships — Not Overwhelm Them

2 min read

Team Helios : Updated on January 19, 2026

For financial advisors to differentiate themselves in this crowded industry, they actually have to be different. But firms looking to leverage their investment prowess as a core differentiator are challenged by the current landscape of cookie-cutter model portfolios and underwhelming outsourced solutions.

And advisors crafting personalized investment models face what has traditionally been a time-consuming, resource-intensive process, requiring sifting through mountains of data, analyzing complex financial instruments, and meticulously constructing portfolios tailored to each client’s unique needs.

This approach, while undeniably powerful, was historically reserved for ultra-high-net-worth clients. The sheer amount of work involved simply wasn’t feasible for advisors to execute for every investor.

Until now.

Beyond Generic, Personalized for Every Client

Advancements in technology have revolutionized the landscape. We’ve witnessed the rise of personalization at scale, empowering you to effortlessly create customized portfolios for a broader investor base.

This innovative approach allows you to leverage your investment expertise while the solution handles the heavy lifting, freeing up valuable time and resources.

At Helios, we’re obsessed with helping you achieve true customization with precision and speed. Portfolios within our robust model ecosystem can be blended easily (and nearly endlessly), empowering you to create strategies that reflect your unique philosophy and resonate with diverse client preferences — whatever they may be.

By embracing the latest technologies, such as machine learning, we’re redefining investment research and execution, leading to more efficient and effective strategies.

Beyond the One-Size-Fits-All Approach

Remember the frustration of watching your dad’s advisor chase past performance? Focusing solely on the market’s hot trends is a common pitfall that can trap investors in a cycle of buying high and selling low, driven by emotions rather than a long-term strategy.

That cycle — or, as we call it, an emotional investing rollercoaster — is what customized quantitative models were designed to combat. They address the core issue: human nature’s tendency to chase the “flavor-of-the-month” and abandon strategies during challenging periods.

Our customized investment models blend your expert investment philosophy with a data-driven framework to create a personalized roadmap for your clients. This combination offers the durability to weather market ups and downs, keeping clients invested for the long haul and maximizing their potential for long-term compounding.

Think of it as the perfect marriage of your investment philosophy and cold, hard math to create portfolios that:

This level of customization fosters a deeper understanding between your clients and their investments. They gain valuable insights into the rationale behind every investment decision, which translates to increased engagement and satisfaction.

Why Customize With Helios

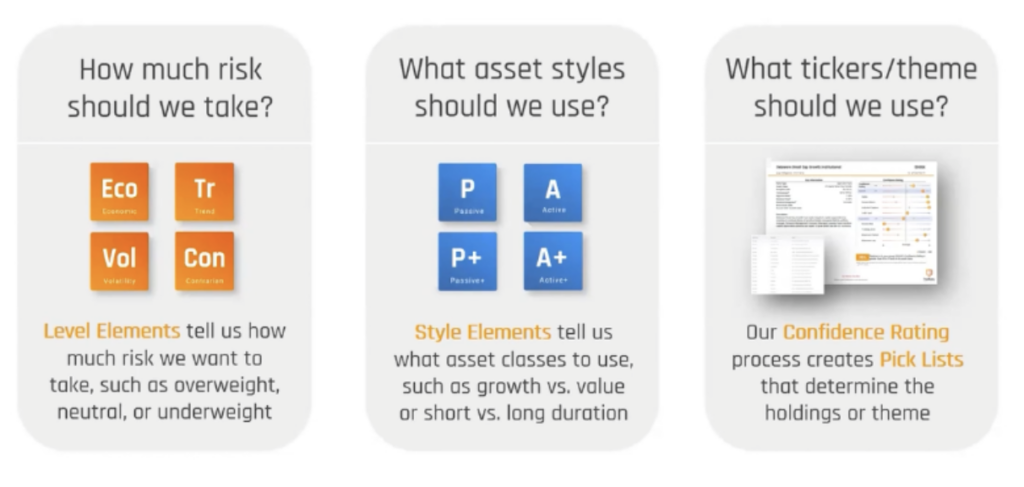

At Helio, we provide the capabilities of an entire investment department without the cost, headache, or hassle that comes with an internal team. Each model is unique and driven by a specific goal. You have complete control over key investment parameters, such as risk tolerance, asset styles, and specific investments.

With a variety of model types at your disposal, you can create portfolios with lower cross-correlation. This enhanced diversification helps mitigate risk, smooth out returns over time, and boost client engagement.

Contact Helios today and discover how our models can elevate your client relationships and propel your business forward.

Creating a smoother, more efficient investment management workflow can give your practices huge advantages. It can free up valuable time, decrease...

Modern clients want sophisticated investment strategies, personalized solutions, and proactive guidance through market volatility. Meanwhile,...

For advisors seeking to optimize their clients’ portfolios by reducing risk and enhancing returns, quantitative investing is a powerful tool....