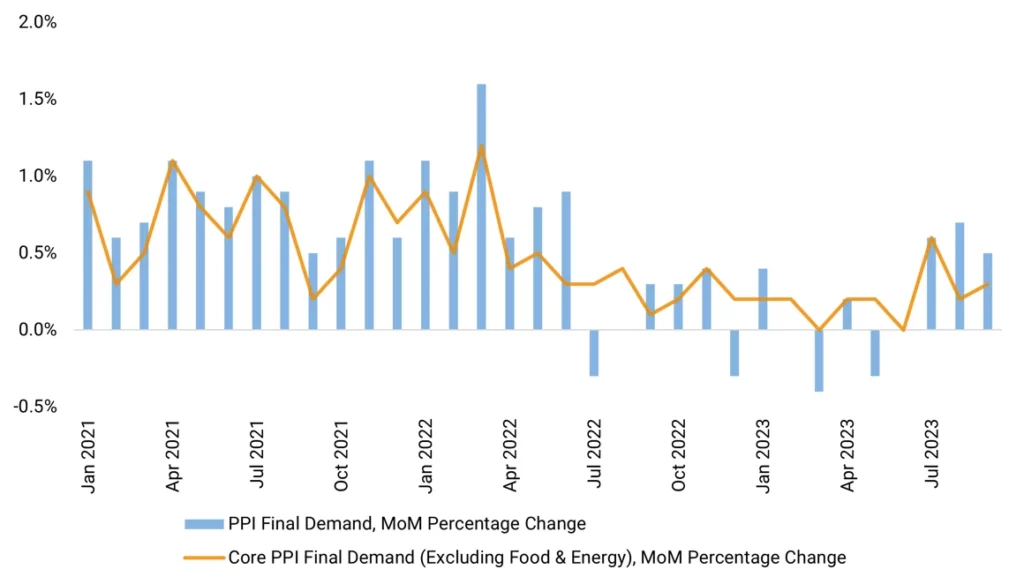

- Prices paid to US producers rose by 0.5% in September due to increased energy and food costs, making it the third consecutive rise. Notably, gasoline prices rose by 5.4%. On an annual basis, the Producer Price Index (PPI) rose to 2.2%, exceeding the forecasted 1.6%.

- Excluding energy and food, the core PPI rose by 0.3% last month and 2.7% for the year, exceeding the expected 2.3% increase.

- Rising oil prices are causing concerns about producer inflation, especially with the ongoing conflict in Israel potentially maintaining high costs. The Federal Reserve closely monitors the PPI report, using certain categories for its preferred inflation measure.

- Consumer prices also increased last month; the Consumer Price Index (CPI) rose 0.4%, primarily due to higher energy costs. Among non-food and energy items, the core CPI increased 0.3%.

- The recent increases in both consumer and producer prices may propel the Federal Reserve to hike interest rates once more before the end of the year.

Source: Helios Quantitative Research, Bloomberg, Bureau of Labor Statistics