Listen on Apple Podcast Follow HQR on Twitter @heliosqr Follow Nyle on Twitter @nylebayer Follow Joe on Twitter @joseph_mallen Follow Jason on Twitter @jasonvanthiel

In this episode, Nyle Bayer discusses the October MTD performance of equities and fixed income as well as current economic conditions with Joe Mallen, Chief Investment Officer, and Jason Van Thiel, Director of Research for Helios Quantitative Research.

Helios Quantitative Research influences over 700 Financial Advisors and $30 billion in assets by creating, implementing, and monitoring quantitative asset allocation strategies. Questions covered: Equities

- What happens to tech companies if their rapid growth slows or halts?

- Should you adjust your strategy to account for all of the volatility we’re seeing?

Fixed Income

- Bonds are boring, but isn’t that the point?

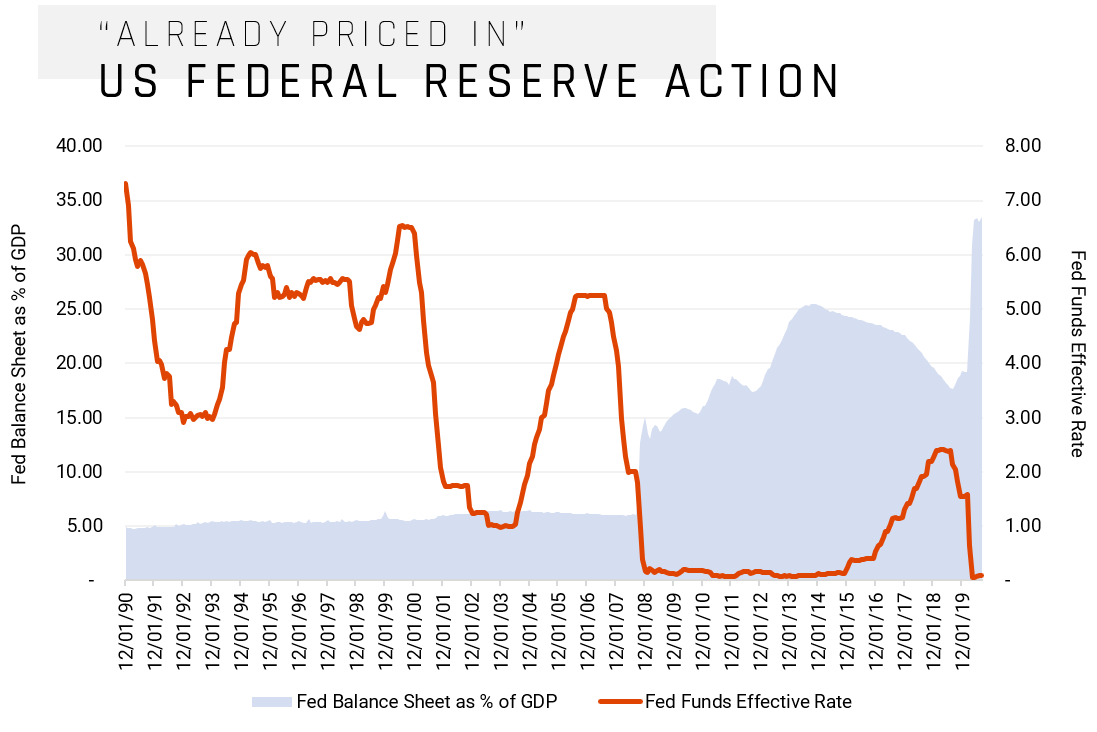

Economy

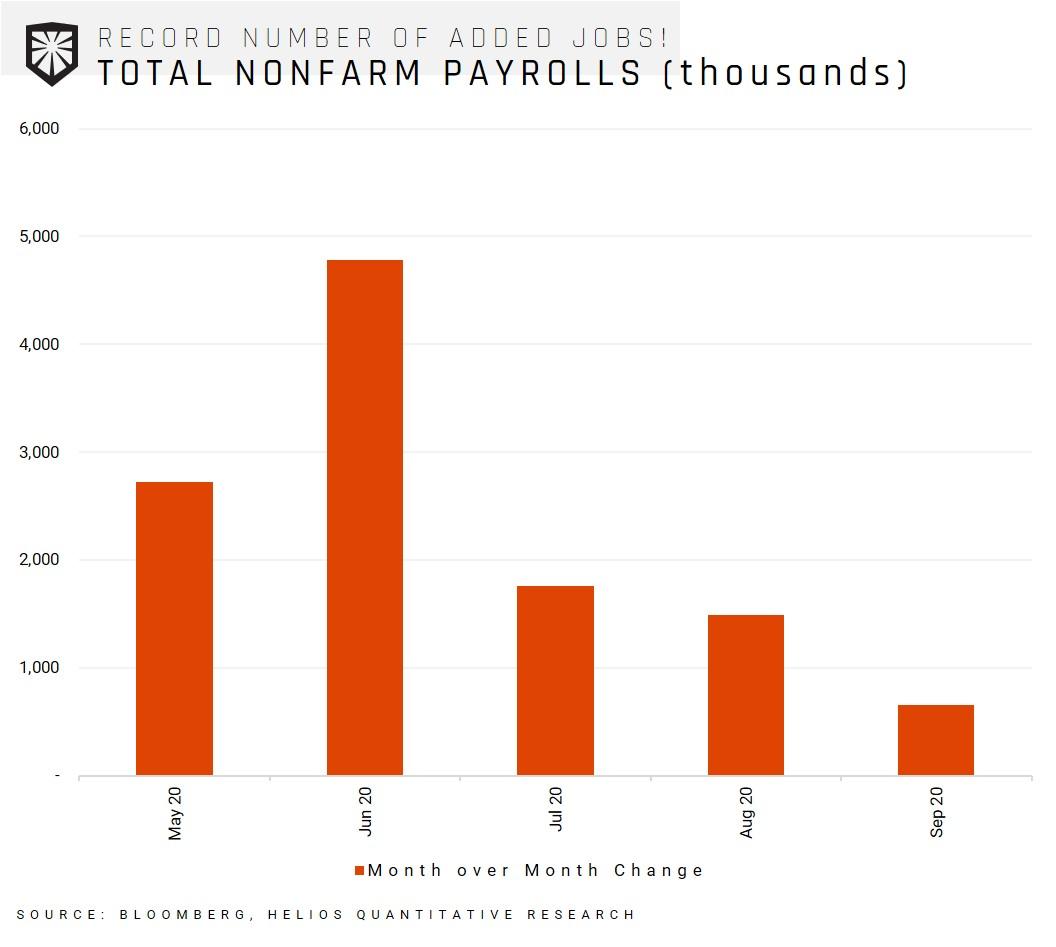

- What do we make of the most recent jobs report?

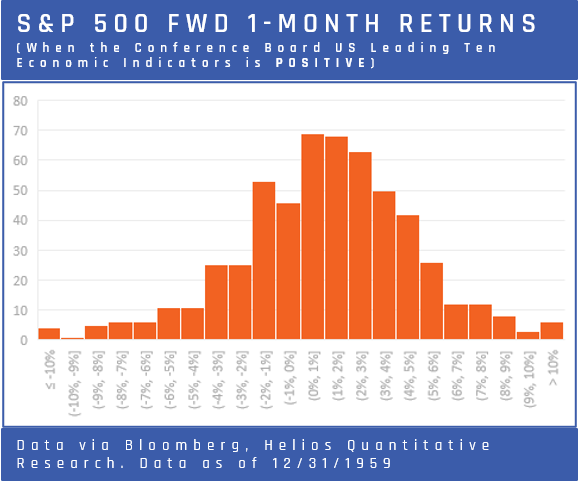

- What are the leading economic indicators telling us?

Random Question(s)

- How much of a portfolio would you allocate to asteroid mining?

Charts mentioned