Listen on Apple Podcast Follow HQR on Twitter @heliosqr Follow Nyle on Twitter @nylebayer Follow Joe on Twitter @joseph_mallen Follow Jason on Twitter @jasonvanthiel

In this episode, Nyle Bayer discusses the August MTD performance of equities and fixed income as well as current economic conditions with Joe Mallen, Chief Investment Officer, and Jason Van Thiel, Director of Research for Helios Quantitative Research.

Helios Quantitative Research influences over 700 Financial Advisors and $30 billion in assets by creating, implementing, and monitoring quantitative asset allocation strategies.

Questions covered: Equities

- Are these current performance numbers sustainable?

- What key metrics should advisors be looking at to help keep them on their path?

- Are tech companies the new defensive play in 2020?

Fixed Income

- What’s driving returns in the fixed income market?

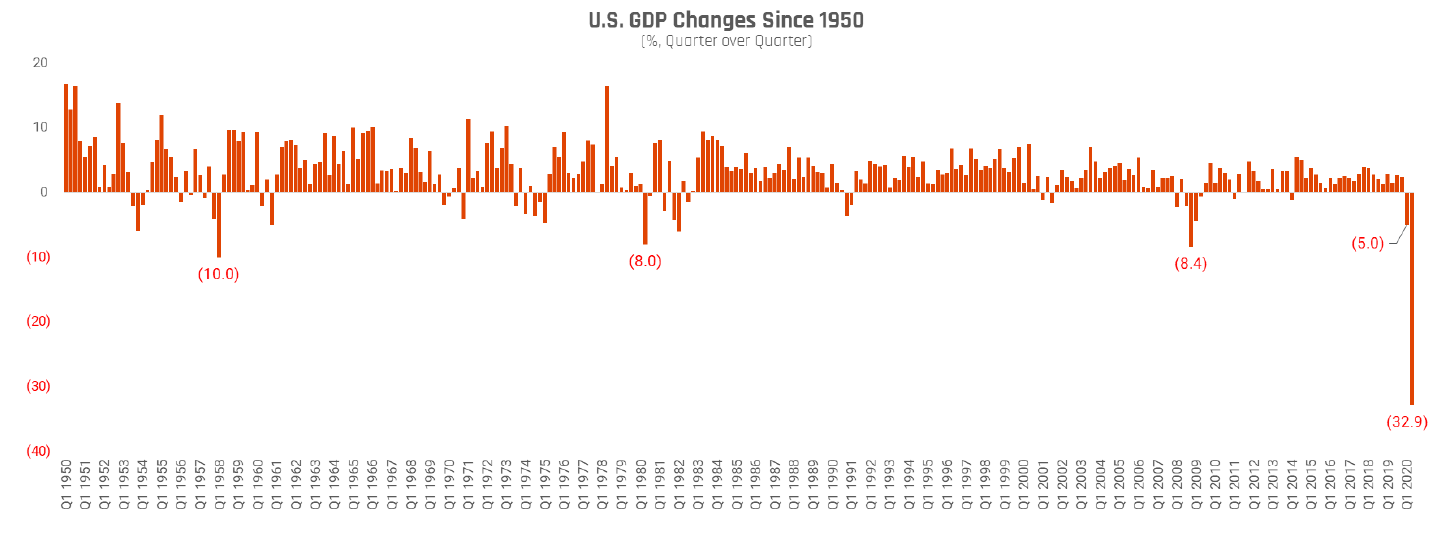

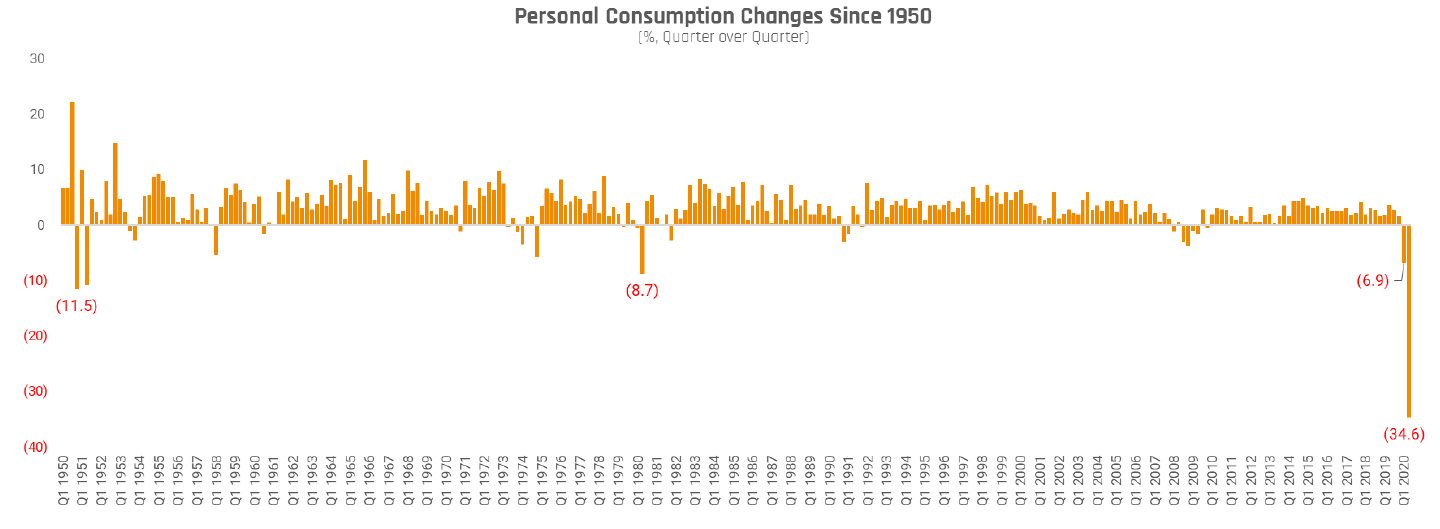

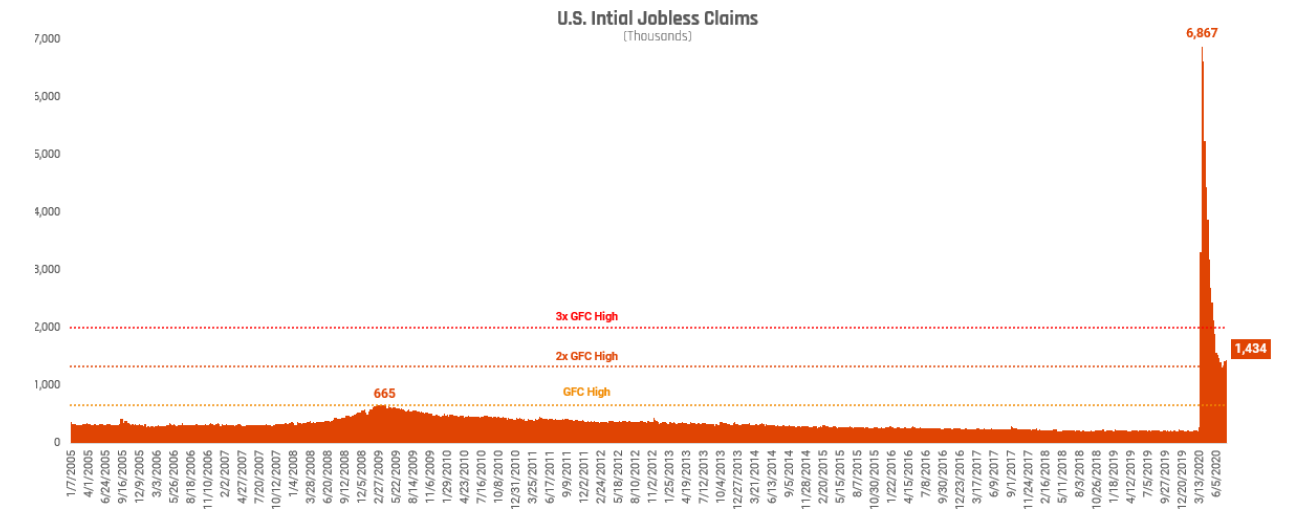

Economy

- Should we be expecting more or less quantitative easing than we’ve seen in the past?

- Will interest rates remain low for the foreseeable future? What does that mean for yields?

Random Question(s)

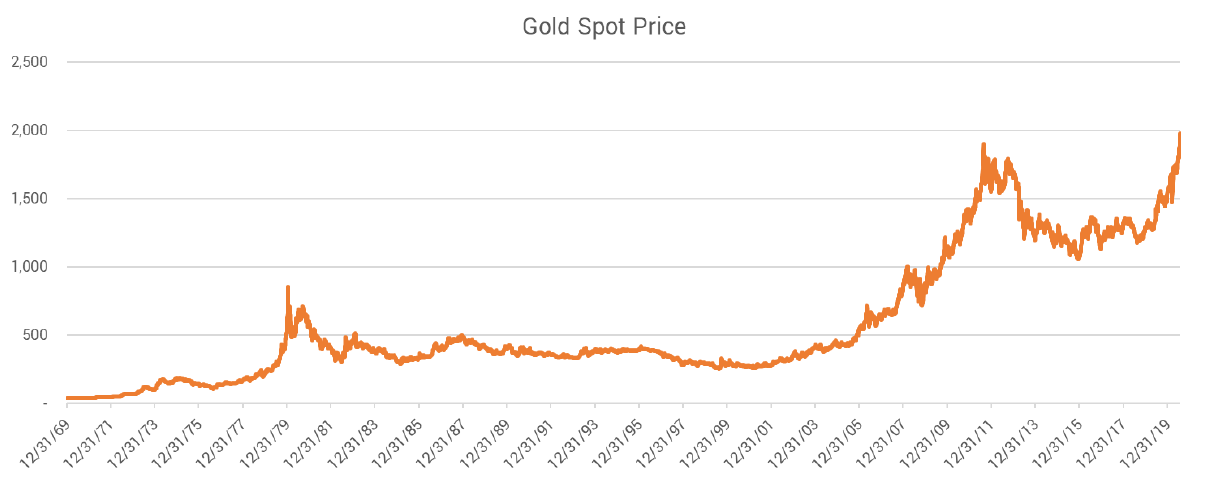

- Is gold a trade or an investment? Is it a sentiment-reader?

Charts mentioned