Listen on Apple Podcast Follow HQR on Twitter @heliosqr Follow Nyle on Twitter @nylebayer Follow Joe on Twitter @joseph_mallen Follow Jason on Twitter @jasonvanthiel In this episode, Nyle Bayer discusses the June MTD performance of equities and fixed income as well as current economic conditions with Joe Mallen, Chief Investment Officer, and Jason Van Thiel, Director of Research for Helios Quantitative Research. Helios Quantitative Research influences over 700 Financial Advisors and $30 billion in assets by creating, implementing, and monitoring quantitative asset allocation strategies. Questions covered: Equities

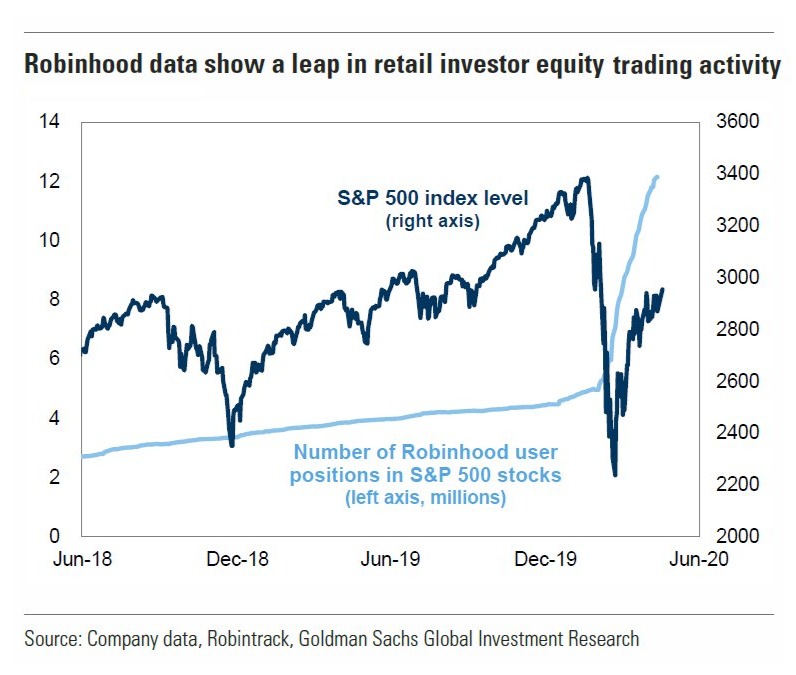

- Why is this market at the current level even though there is plenty of reasonable reasons for it to be much lower?

- Are clients still uncomfortable with the market rally even though their accounts are recovering?

- How can advisors frame discussions with retail traders that have performed well in recent months and do not want to prudently manage their long term investments?

- Is rotating the Morningstar style box a smart idea?

Fixed Income

- How does a Financial Advisor make sense of all of the solutions available to me in the bond space?

Economy

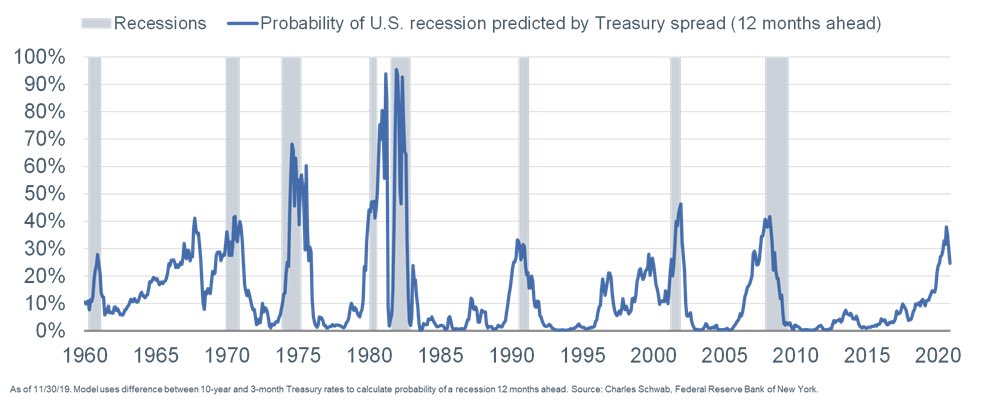

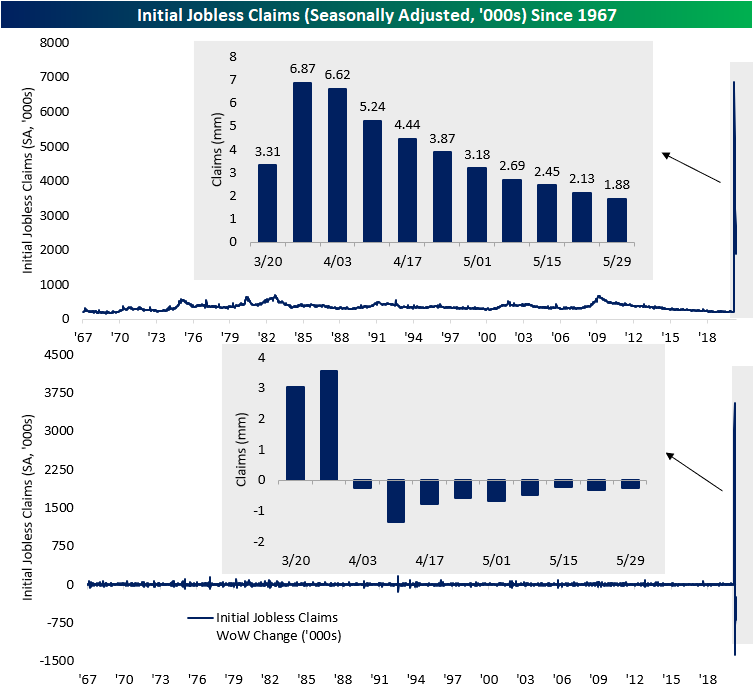

- What is the major difference in leading and lagging indicators and how are they affecting the market?

- What are the second and third-order effects of the economic shutdown and how is that playing out now?

Random questions What’s your favorite chart of the month? Charts mentioned